Question: ssignment: Chapter 06 Using Credit a Search Van wants to determine his current debt safety ratio. His monthly take home pay is $5,000. He compiled

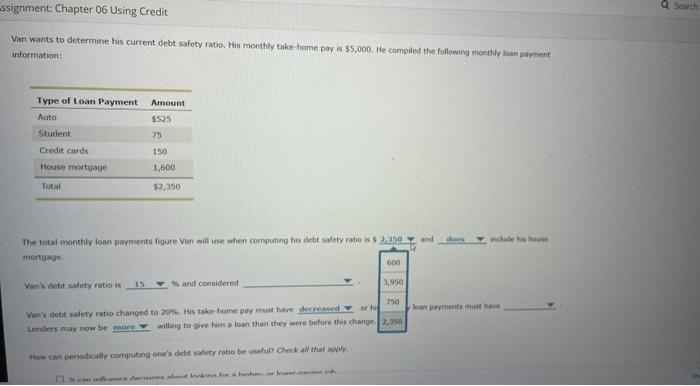

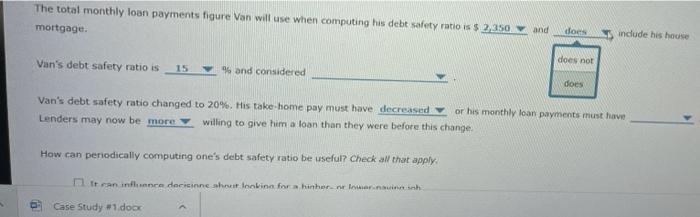

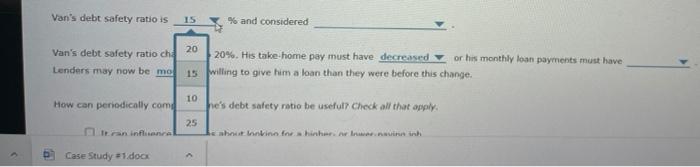

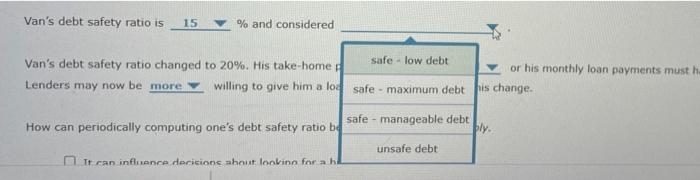

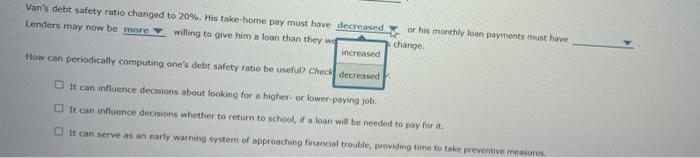

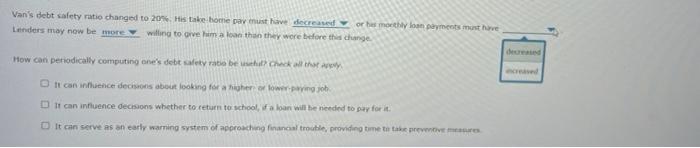

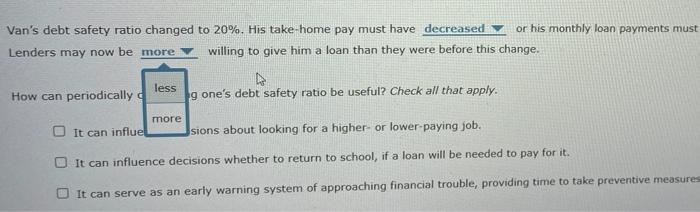

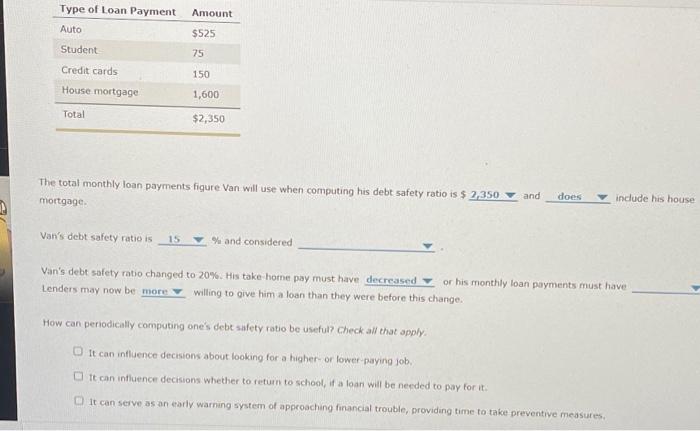

ssignment: Chapter 06 Using Credit a Search Van wants to determine his current debt safety ratio. His monthly take home pay is $5,000. He compiled the following monthly loan payment information: Amount $525 75 Type of Loan Payment Auto Student Credit cards House mortgage Total 150 1,600 52,350 ders include he ha The total monthly loan payments figure Van will use when computing his debit safety rate is $250 and mortgage . 600 Van's debt safety ratio is 15 and considered 3,950 750 loan ryments must have Van's debt safety rato changed to 20%. His take home pay must have decreased or Lenders may now be more willing to give him a loan than they were before this change. 2.350 How can periodically computing one's debt safety ratio be useful? Check all that apply Dan dari suri boshti The total monthly loan payments figure Van will use when computing his debt safety ratio is $ 2,350 and mortgage. does indude his house Van's debt safety ratio is does not 15 % and considered does Van's debt safety ratio changed to 20%. His take-home pay must have decreased or his monthly loan payments must have Lenders may now be more willing to give him a loan than they were before this change How can periodically computing one's debt safety ratio be useful? Check all that apply it can influence decisione she lookinn for hiberner Internacio Case Study #1.doc Van's debt safety ratio is 15 % and considered Van's debt safety ratio che Lenders may now be me 20 20%. His take-home pay must have decreased or his monthly loan payments must have 15 Willing to give him a loan than they were before this change. 10 How can periodically comd he's debt safety ratio be useful? Check all that apply 25 tran infloral but Iankinn for hinar Iranih Case Study #1.docx Van's debt safety ratio is 15 % and considered safe - low debt Van's debt safety ratio changed to 20%. His take-home or his monthly loan payments must h Lenders may now be more willing to give him a lod safe - maximum debt his change. How can periodically computing one's debt safety ratio bd safe - manageable debt ply. unsafe debt It can influence dericions about looking for a hel Van's debt safety ratio changed to 20%. His take home pay must have decreased Lenders may now be more willing to give him a loan than they we increased How can periodically computing one's debt safety ratio be useful? Check decreased or his monthly loan payments must have change It can influence decisions about looking for a higher or lower paying job, It can influence decisions whether to return to school, a loan will be needed to pay for it It can serve as an early warning system of approaching financial trouble, providing time to take preventive measures Van's debt safety ratio changed to 20%. His take home pay must have decreased or hus monthly loan payments must have Lenders may now be more willing to give him a loan than they were before the change How can periodically computing one's debt lety ratio best check that It can influence decisions about looking for a higher or lowering job It can influence decisions whether to return to school, a loan will he needed to pay for it It can serve as an early warning system of approaching financial trouble, providing time to take prevents Van's debt safety ratio changed to 20%. His take-home pay must have decreased or his monthly loan payments must Lenders may now be more willing to give him a loan than they were before this change. less How can periodically g one's debt safety ratio be useful? Check all that apply. more It can influe sions about looking for a higher or lower-paying job. It can influence decisions whether to return to school, if a loan will be needed to pay for it. It can serve as an early warning system of approaching financial trouble, providing time to take preventive measures How can periodically computing one's debt safety ratio be useful? Check all that apply. It can influence decisions about looking for a higher or lower paying job. It can influence decisions whether to return to school, a loan will be needed to pay for it. It can serve as an early warning system of approaching financial trouble, providing time to take preventive measures Type of Loan Payment Amount Auto $525 Student 75 Credit cards 150 House mortgage 1,600 Total $2,350 The total monthly loan payments figure Van will use when computing his debt safety ratio is $ 2,350 and mortgage does indude his house Van's debt safety ratio is 15 % and considered Van's debt safety ratio changed to 20%. His take home pay must have decreased or his monthly loan payments must have Lenders may now be more willing to give him a loan than they were before this change. How can periodically computing one's debt safety ratio be useful? Check all that apply It can influence decisions about looking for a higher or lower paying job. It can influence decisions whether to return to school, if a loan will be needed to pay for it It can serve as an early warning system of approaching financial trouble, providing time to take preventive measures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts