Question: ws 6.01 Use Worksheet 6.1. katheme Hunt is eving her debe safety rate. Her monthly take home pay is $3.590. Nach month, the pays 150

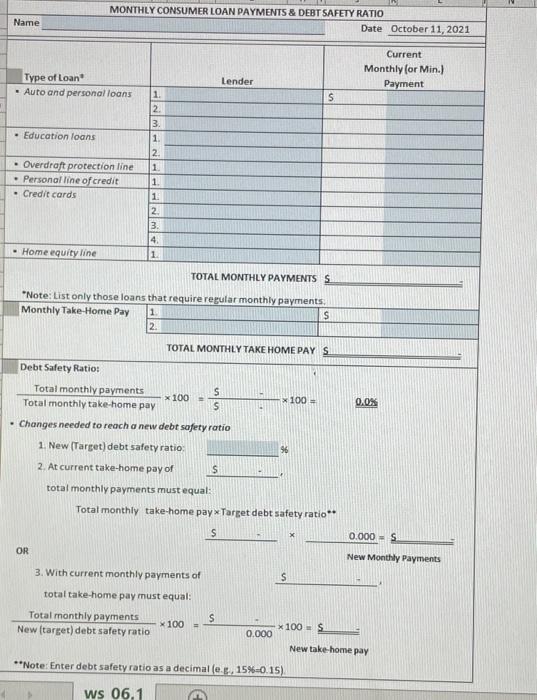

Use Worksheet 6.1. katheme Hunt is eving her debe safety rate. Her monthly take home pay is $3.590. Nach month, the pays 150 ton to low, 5100 department store charge card, and 505 on her bank credit card. Complete Worksheet 6.1 by iting Kathere's outstanding debts, and then calculate her det safety rate on the 1 deomal pact. Enter debt safety ratio as a percentage Gven her current take home pay, what at the maximum amount of month debt payments that othenne can have t she wants her debt solety rata ta de 10.0 percent Round bewertu me nearest dollar $ Given her current monthly debt payment load, what would Katherine's take home pay have to be if she wanted a 100 percent de safety ? Hound the answer to the seat does $ Name MONTHLY CONSUMER LOAN PAYMENTS & DEBT SAFETY RATIO Date October 11, 2021 Type of Loan Auto and personal loans Current Monthly for Min.) Payment Lender S Education loans Overdraft protection line - Personal line of credit Credit cards 1. 2. 3. 1. 2. 1 1. 1 2. 3. 4. 1 - Home equity line TOTAL MONTHLY PAYMENTS S *Note: List only those loans that require regular monthly payments Monthly Take-Home Pay 1 s 2. TOTAL MONTHLY TAKE HOME PAY S Debt Safety Ratio: 0.0% Total monthly payments S *100= * 100 Total monthly take home pay s Changes needed to reach a new debt safety ratio 1. New (Target) debt safety ratio: 96 2. At current take-home pay of $ total monthly payments must equal: Total monthly take-home pay Target debt safety ratio** $ 0.000 = 5 OR New Monthly Payments 3. With current monthly payments of S total take home pay must equal Total monthly payments New (target) debt safety ratio S x 100 x 100 $ 0.000 New take home pay **Note: Enter debt safety ratio as a decimal(e., 15%-0.15) ws 06.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts