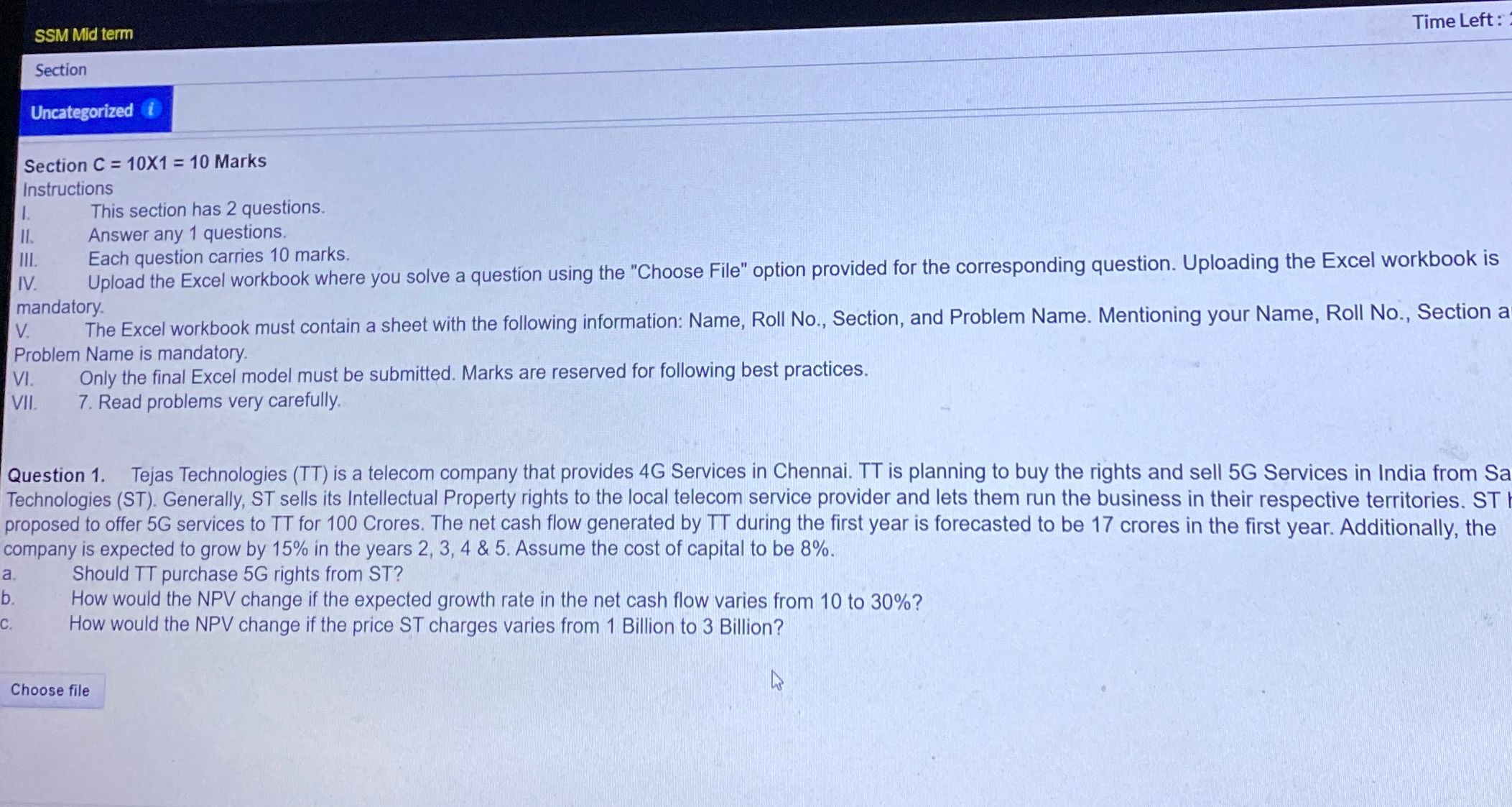

Question: SSM Mid term Time Left: Section Uncategorized i Section C = 1 0 1 = 1 0 Marks Instructions I. This section has 2 questions.

SSM Mid term

Time Left:

Section

Uncategorized

Section Marks

Instructions

I. This section has questions.

II Answer any questions.

III. Each question carries marks.

IV Upload the Excel workbook where you solve a question using the "Choose File" option provided for the corresponding question. Uploading the Excel workbook is mandatory.

V The Excel workbook must contain a sheet with the following information: Name, Roll No Section, and Problem Name. Mentioning your Name, Roll No Section a Problem Name is mandatory.

VI Only the final Excel model must be submitted. Marks are reserved for following best practices.

VII. Read problems very carefully.

Question Tejas Technologies TT is a telecom company that provides G Services in Chennai. TT is planning to buy the rights and sell Services in India from Sa Technologies ST Generally, ST sells its Intellectual Property rights to the local telecom service provider and lets them run the business in their respective territories. ST proposed to offer services to TT for Crores. The net cash flow generated by TT during the first year is forecasted to be crores in the first year. Additionally, the company is expected to grow by in the years & Assume the cost of capital to be

a Should TT purchase rights from ST

b How would the NPV change if the expected growth rate in the net cash flow varies from to

c How would the NPV change if the price ST charges varies from Billion to Billion?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock