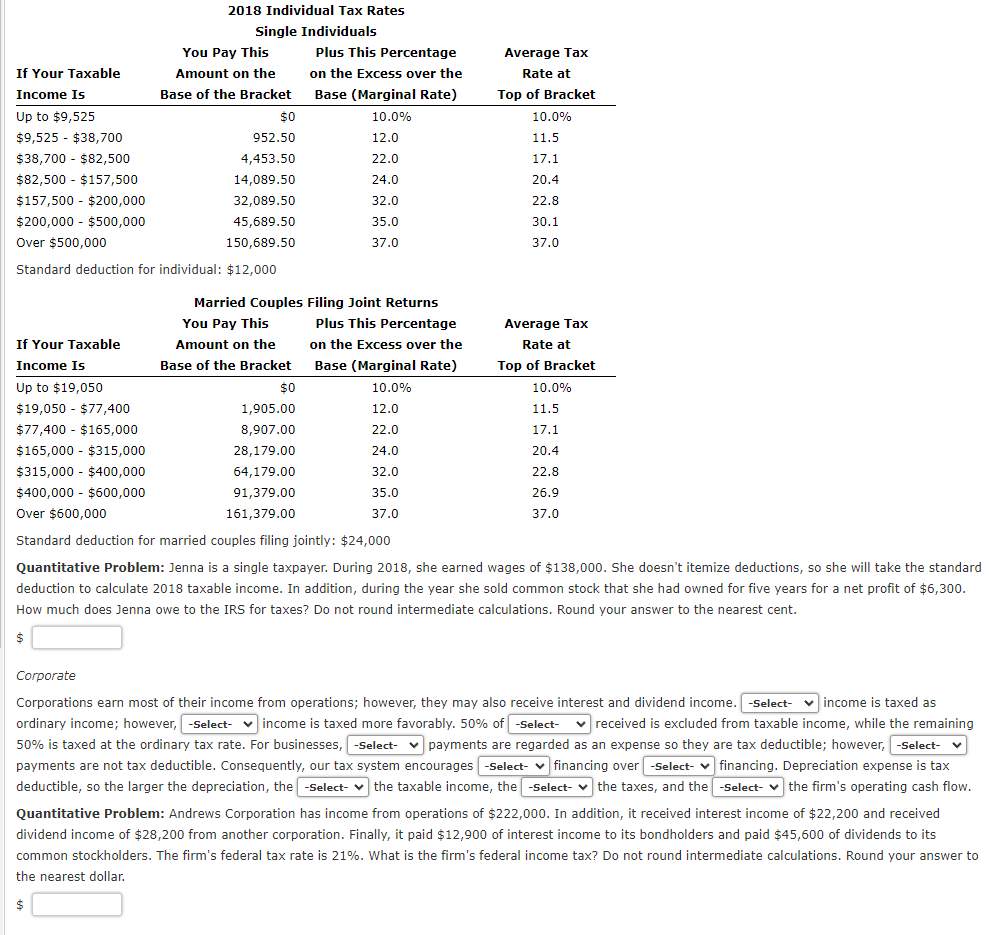

Question: Standard deduction for married couples filing jointly: $24,000 Quantitative Problem: Jenna is a single taxpayer. During 2018, she earned wages of $138,000. She doesn't itemize

Standard deduction for married couples filing jointly: $24,000 Quantitative Problem: Jenna is a single taxpayer. During 2018, she earned wages of $138,000. She doesn't itemize deductions, so she will take the standard deduction to calculate 2018 taxable income. In addition, during the year she sold common stock that she had of $300. How much does Jenna owe to the IRS for taxes? Do not round intermediate calculations. Round your answer to the nearest cent. $ Corporate Quantitative Problem: Andrews Corporation has income from operations of $222,000. In addition, it received interest income of $22,200 and received common stockholders. The firm's federal tax rate is 21%. What is the firm's federal income tax? Do not round intermediate calculations. Round your answer to the nearest dollar. Standard deduction for married couples filing jointly: $24,000 Quantitative Problem: Jenna is a single taxpayer. During 2018, she earned wages of $138,000. She doesn't itemize deductions, so she will take the standard deduction to calculate 2018 taxable income. In addition, during the year she sold common stock that she had of $300. How much does Jenna owe to the IRS for taxes? Do not round intermediate calculations. Round your answer to the nearest cent. $ Corporate Quantitative Problem: Andrews Corporation has income from operations of $222,000. In addition, it received interest income of $22,200 and received common stockholders. The firm's federal tax rate is 21%. What is the firm's federal income tax? Do not round intermediate calculations. Round your answer to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts