Question: Stanley Industries is evaluating a proposal to expand its current distribution facilities. Management has projected that the project will produce the following additional cash

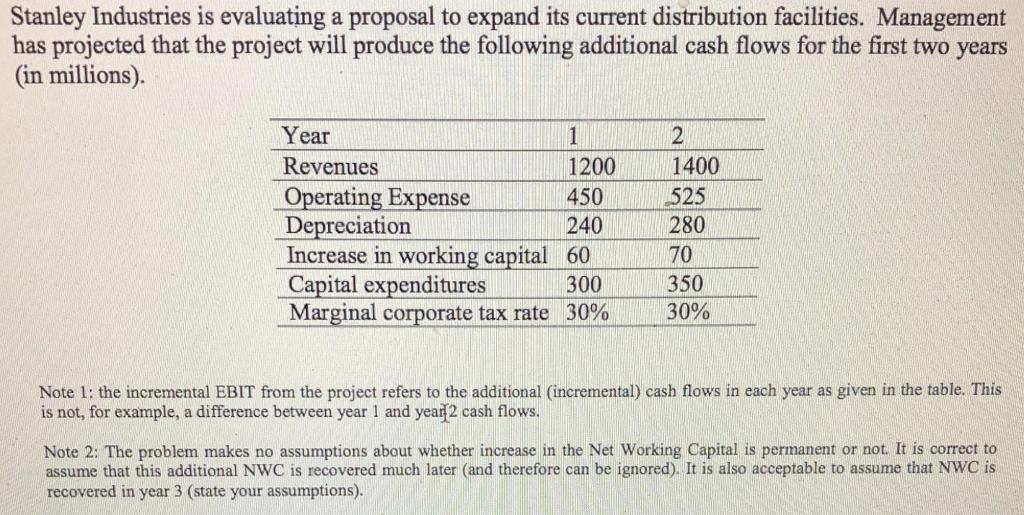

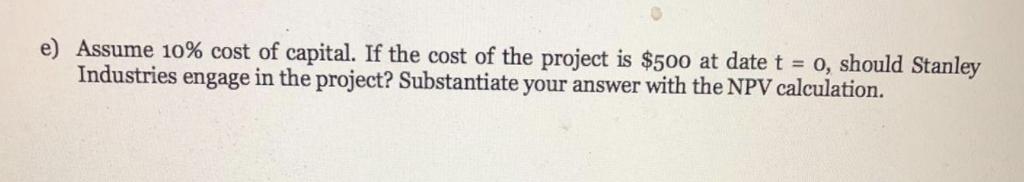

Stanley Industries is evaluating a proposal to expand its current distribution facilities. Management has projected that the project will produce the following additional cash flows for the first two years (in millions). Year Revenues Operating Expense Depreciation 1 1200 450 240 60 300 Increase in working capital Capital expenditures Marginal corporate tax rate 30% 2 1400 525 280 70 350 30% Note 1: the incremental EBIT from the project refers to the additional (incremental) cash flows in each year as given in the table. This is not, for example, a difference between year 1 and year 2 cash flows. Note 2: The problem makes no assumptions about whether increase in the Net Working Capital is permanent or not. It is correct to assume that this additional NWC is recovered much later (and therefore can be ignored). It is also acceptable to assume that NWC is recovered in year 3 (state your assumptions). Assume 10% cost of capital. If the cost of the project is $500 at date t = 0, should Stanley Industries engage in the project? Substantiate your answer with the NPV calculation.

Step by Step Solution

3.54 Rating (151 Votes )

There are 3 Steps involved in it

1 2 3 4 5 10 6 7 8 9 10 11 12 13 14 15 16 17 A B Cost Revenue Operatin exp... View full answer

Get step-by-step solutions from verified subject matter experts