Question: Stanley is a mean-variance optimising investor with risk-aversion A = 4. Suppose Stanley can choose two stocks for his investment portfolio. The first stock has

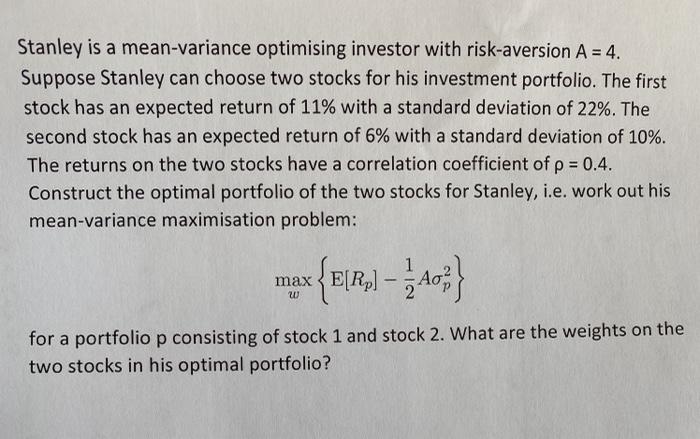

Stanley is a mean-variance optimising investor with risk-aversion A = 4. Suppose Stanley can choose two stocks for his investment portfolio. The first stock has an expected return of 11% with a standard deviation of 22%. The second stock has an expected return of 6% with a standard deviation of 10%. The returns on the two stocks have a correlation coefficient of p = 0.4. Construct the optimal portfolio of the two stocks for Stanley, i.e. work out his mean-variance maximisation problem: max {E[R,1 540;} for a portfolio p consisting of stock 1 and stock 2. What are the weights on the two stocks in his optimal portfolio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock