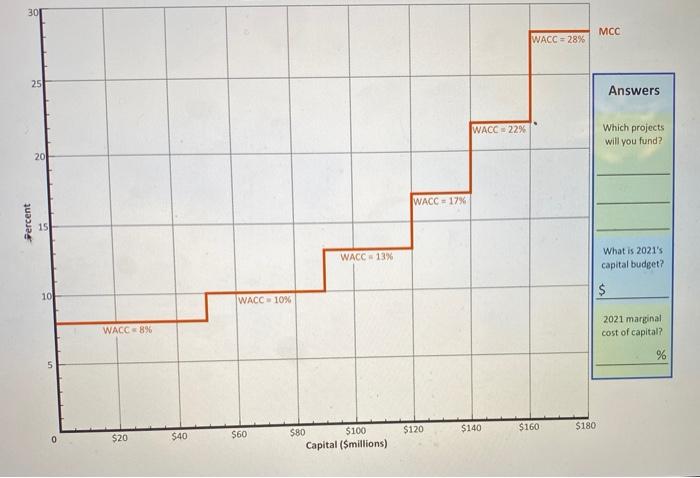

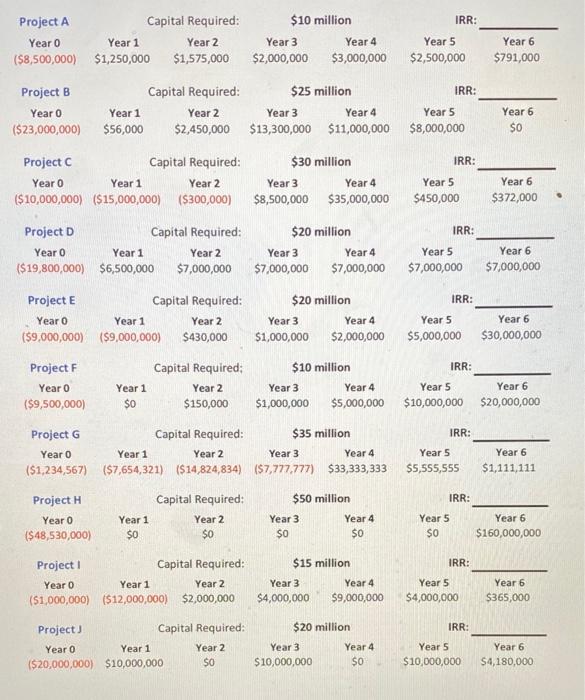

Question: Start drawing the projects on the graph. It already has your Marginal Cost of Capital schedule on it. You're adding the Investment Opportunity Schedule. You

30 MCC WACC = 28% 25 Answers WACC 22% Which projects Will you fund? 20 WACC = 17% Fercent WACC - 13% What is 2021's capital budget? $ 10 WACC - 10% WACC8% 2021 marginal cost of capital? % 5 $140 $120 $180 $160 $20 $40 $60 $80 $100 Capital (Smillions) IRR: Project A Capital Required: Year 0 Year 1 Year 2 ($8,500,000) $1,250,000 $1,575,000 $10 million Year 3 Year 4 $2,000,000 $3,000,000 Year 5 $2,500,000 Year 6 $791,000 Year 6 $0 Project B Capital Required: $25 million IRR: Year o Year 1 Year 2 Year 3 Year 4 Year 5 ($23,000,000) $56,000 $2,450,000 $13,300,000 $11,000,000 $8,000,000 Project C Capital Required: $30 million IRR: Year o Year 1 Year 2 Year 3 Year 4 Year 5 ($10,000,000) ($15,000,000) ($300,000) $8,500,000 $35,000,000 $450,000 Year 6 $372,000 Project D Capital Required: Year 0 Year 1 Year 2 ($19,800,000) $6,500,000 $7,000,000 $20 million Year 3 Year 4 $7,000,000 $7,000,000 IRR: Year 5 $7,000,000 Year 6 $7,000,000 IRR: Project E Capital Required: Year o Year 1 Year 2 ($9,000,000) ($9,000,000) $430,000 $20 million Year 3 Year 4 $1,000,000 $2,000,000 Year 5 $5,000,000 Year 6 $30,000,000 Project F Year o ($9,500,000) Year 1 $0 Capital Required: Year 2 $150,000 $10 million Year 3 Year 4 $1,000,000 $5,000,000 IRR: Year 5 Year 6 $10,000,000 $20,000,000 IRR: Project G Capital Required: $35 million Year 0 Year 1 Year 2 Year 3 Year 4 ($1,234,567) ($7,654,321) ($14,824,834) ($7,777777) $33,333,333 Year 5 $5,555,555 Year 6 $1,111,111 $50 million IRR: Project H Year o ($48,530,000) Year 1 $0 Capital Required: Year 2 $0 Year 3 $o Year 4 $0 Year 5 $0 Year 6 $160,000,000 IRR: Project 1 Capital Required: Year o Year 1 Year 2 (51,000,000) ($12,000,000) $2,000,000 $15 million Year 3 Year 4 $4,000,000 $9,000,000 Year 5 $4,000,000 Year 6 $365,000 IRR: Project) Capital Required: Year 0 Year 1 Year 2 ($20,000,000) $10,000,000 SO $20 million Year 3 Year 4 $10,000,000 $0 Year 5 $10,000,000 Year 6 S4,180,000 30 MCC WACC = 28% 25 Answers WACC 22% Which projects Will you fund? 20 WACC = 17% Fercent WACC - 13% What is 2021's capital budget? $ 10 WACC - 10% WACC8% 2021 marginal cost of capital? % 5 $140 $120 $180 $160 $20 $40 $60 $80 $100 Capital (Smillions) IRR: Project A Capital Required: Year 0 Year 1 Year 2 ($8,500,000) $1,250,000 $1,575,000 $10 million Year 3 Year 4 $2,000,000 $3,000,000 Year 5 $2,500,000 Year 6 $791,000 Year 6 $0 Project B Capital Required: $25 million IRR: Year o Year 1 Year 2 Year 3 Year 4 Year 5 ($23,000,000) $56,000 $2,450,000 $13,300,000 $11,000,000 $8,000,000 Project C Capital Required: $30 million IRR: Year o Year 1 Year 2 Year 3 Year 4 Year 5 ($10,000,000) ($15,000,000) ($300,000) $8,500,000 $35,000,000 $450,000 Year 6 $372,000 Project D Capital Required: Year 0 Year 1 Year 2 ($19,800,000) $6,500,000 $7,000,000 $20 million Year 3 Year 4 $7,000,000 $7,000,000 IRR: Year 5 $7,000,000 Year 6 $7,000,000 IRR: Project E Capital Required: Year o Year 1 Year 2 ($9,000,000) ($9,000,000) $430,000 $20 million Year 3 Year 4 $1,000,000 $2,000,000 Year 5 $5,000,000 Year 6 $30,000,000 Project F Year o ($9,500,000) Year 1 $0 Capital Required: Year 2 $150,000 $10 million Year 3 Year 4 $1,000,000 $5,000,000 IRR: Year 5 Year 6 $10,000,000 $20,000,000 IRR: Project G Capital Required: $35 million Year 0 Year 1 Year 2 Year 3 Year 4 ($1,234,567) ($7,654,321) ($14,824,834) ($7,777777) $33,333,333 Year 5 $5,555,555 Year 6 $1,111,111 $50 million IRR: Project H Year o ($48,530,000) Year 1 $0 Capital Required: Year 2 $0 Year 3 $o Year 4 $0 Year 5 $0 Year 6 $160,000,000 IRR: Project 1 Capital Required: Year o Year 1 Year 2 (51,000,000) ($12,000,000) $2,000,000 $15 million Year 3 Year 4 $4,000,000 $9,000,000 Year 5 $4,000,000 Year 6 $365,000 IRR: Project) Capital Required: Year 0 Year 1 Year 2 ($20,000,000) $10,000,000 SO $20 million Year 3 Year 4 $10,000,000 $0 Year 5 $10,000,000 Year 6 S4,180,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts