Question: STATA required Please help me solving this assignment or at least provide screenshot ( Few hours left please soon as possible) Question 1 1. Refer

STATA required

Please help me solving this assignment or at least provide screenshot ( Few hours left please soon as possible)

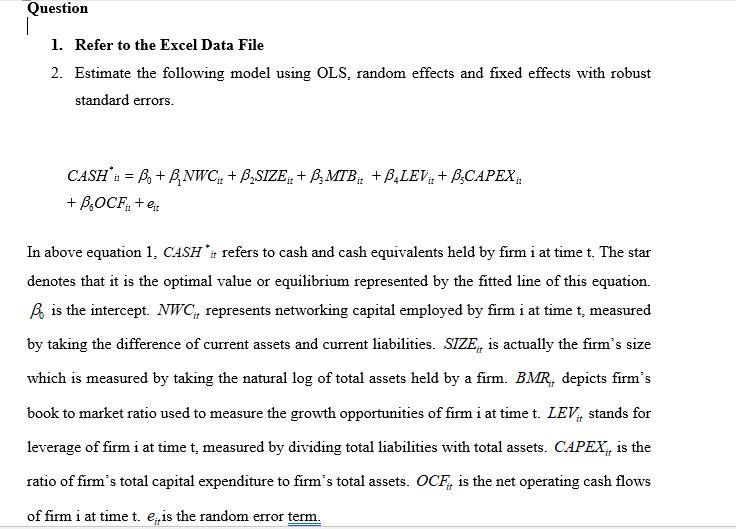

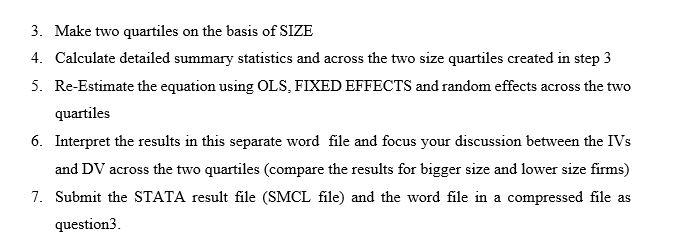

Question 1 1. Refer to the Excel Data File 2. Estimate the following model using OLS, random effects and fixed effects with robust standard errors. CASH a = Bo + BNWC: + B,SIZE: + B, MTB: +B.LEV: + BCAPEX. + B.OCF,+ et In above equation 1, CASH i refers to cash and cash equivalents held by firm i at time t. The star denotes that it is the optimal value or equilibrium represented by the fitted line of this equation. By is the intercept. NWC, represents networking capital employed by firm i at time t, measured by taking the difference of current assets and current liabilities. SIZE,, is actually the firm's size which is measured by taking the natural log of total assets held by a firm. BMR, depicts firm's book to market ratio used to measure the growth opportunities of firm i at time t. LEV, stands for leverage of firm i at time t, measured by dividing total liabilities with total assets. CAPEX, is the ratio of firm's total capital expenditure to firm's total assets. OCF, is the net operating cash flows of firm i at time t. e, is the random error term. 3. Make two quartiles on the basis of SIZE 4. Calculate detailed summary statistics and across the two size quartiles created in step 3 5. Re-Estimate the equation using OLS, FIXED EFFECTS and random effects across the two quartiles 6. Interpret the results in this separate word file and focus your discussion between the IVs and DV across the two quartiles (compare the results for bigger size and lower size firms) 7. Submit the STATA result file (SMCL file) and the word file in a compressed file as question3. Question 1 1. Refer to the Excel Data File 2. Estimate the following model using OLS, random effects and fixed effects with robust standard errors. CASH a = Bo + BNWC: + B,SIZE: + B, MTB: +B.LEV: + BCAPEX. + B.OCF,+ et In above equation 1, CASH i refers to cash and cash equivalents held by firm i at time t. The star denotes that it is the optimal value or equilibrium represented by the fitted line of this equation. By is the intercept. NWC, represents networking capital employed by firm i at time t, measured by taking the difference of current assets and current liabilities. SIZE,, is actually the firm's size which is measured by taking the natural log of total assets held by a firm. BMR, depicts firm's book to market ratio used to measure the growth opportunities of firm i at time t. LEV, stands for leverage of firm i at time t, measured by dividing total liabilities with total assets. CAPEX, is the ratio of firm's total capital expenditure to firm's total assets. OCF, is the net operating cash flows of firm i at time t. e, is the random error term. 3. Make two quartiles on the basis of SIZE 4. Calculate detailed summary statistics and across the two size quartiles created in step 3 5. Re-Estimate the equation using OLS, FIXED EFFECTS and random effects across the two quartiles 6. Interpret the results in this separate word file and focus your discussion between the IVs and DV across the two quartiles (compare the results for bigger size and lower size firms) 7. Submit the STATA result file (SMCL file) and the word file in a compressed file as question3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts