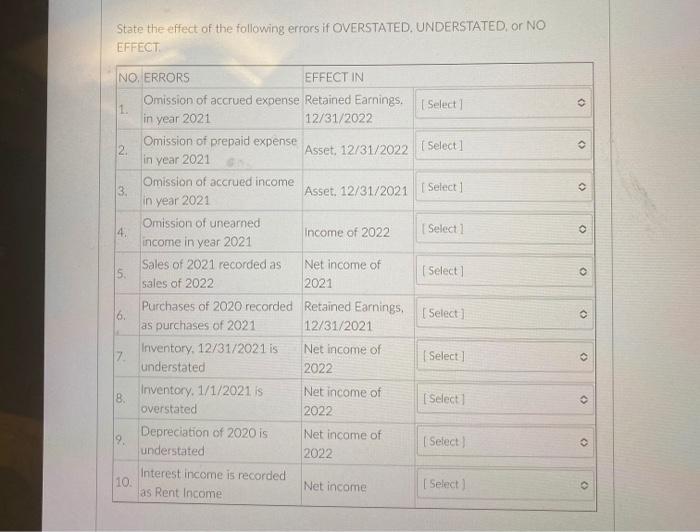

Question: State the effect of the following errors if OVERSTATED, UNDERSTATED, or NO EFFECT. NO. ERRORS EFFECT IN Omission of accrued expense Retained Earnings, I

State the effect of the following errors if OVERSTATED, UNDERSTATED, or NO EFFECT. NO. ERRORS EFFECT IN Omission of accrued expense Retained Earnings, I Select] 1. in year 2021 12/31/2022 Omission of prepaid expense 2. in year 2021 Asset, 12/31/2022 Select] Omission of accrued income 3. in year 2021 Asset. 12/31/2021 Select] Omission of unearned 4. income in year 2021 Income of 2022 [ Select ) Sales of 2021 recorded as 5. sales of 2022 Net income of 2021 ( Select Purchases of 2020 recorded Retained Earnings, 6. as purchases of 2021 [Select] 12/31/2021 Inventory, 12/31/2021 is 7. understated Net income of [ Select] 2022 Inventory, 1/1/2021 is Net income of [ Select ] overstated 2022 Depreciation of 2020 is 9. Net income of 2022 ( Select understated Interest income is recorded 10 as Rent Income Net income [ Select )

Step by Step Solution

3.47 Rating (176 Votes )

There are 3 Steps involved in it

No 1 12 3 4 LO 5 16 7 8 19 1... View full answer

Get step-by-step solutions from verified subject matter experts