Question: State the formula for ROE From the Table, insert the values for NI and Equity. Interpret your results. The balance sheet and income statement shown

- State the formula for ROE

- From the Table, insert the values for NI and Equity.

- Interpret your results.

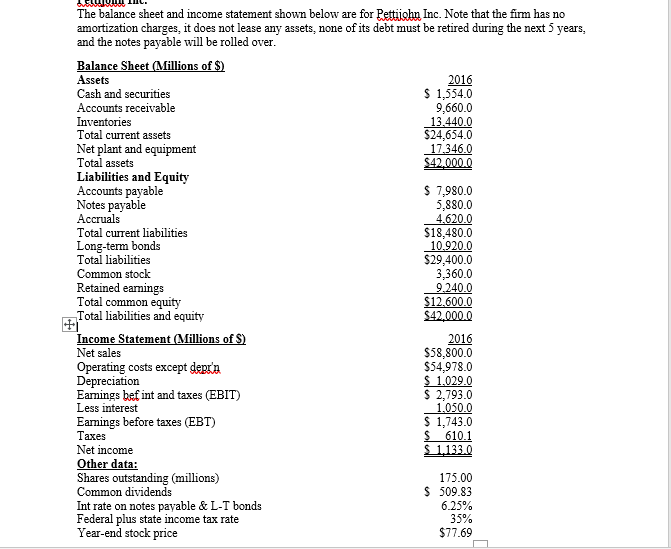

The balance sheet and income statement shown below are for Pettiiohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) Assets 2016 Cash and securities $ 1,554.0 Accounts receivable 9,660.0 Inventories 13,440.0 Total current assets $24,654.0 Net plant and equipment 17,346.0 Total assets $42.000.0 Liabilities and Equity Accounts payable $ 7,980.0 Notes payable 5,880.0 Accruals 4.620.0 Total current liabilities $18,480.0 Long-term bonds 10,920.0 Total liabilities $29,400.0 Common stock 3,360.0 Retained earnings 9.240.0 Total common equity $12.600.0 Total liabilities and equity S42,000.0 Income Statement (Millions of $) 2016 Net sales $58,800.0 Operating costs except deprin $54,978.0 Depreciation $ 1,029.0 Eamings befint and taxes (EBIT) $ 2,793.0 Less interest 1,050.0 Eamings before taxes (EBT) $ 1,743.0 Taxes $ 610.1 Net income S 1.133.0 Other data: Shares outstanding (millions) 175.00 Common dividends $ 509.83 Intrate on notes payable & L-T bonds 6.25% Federal plus state income tax rate 35% Year-end stock price $77.69

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts