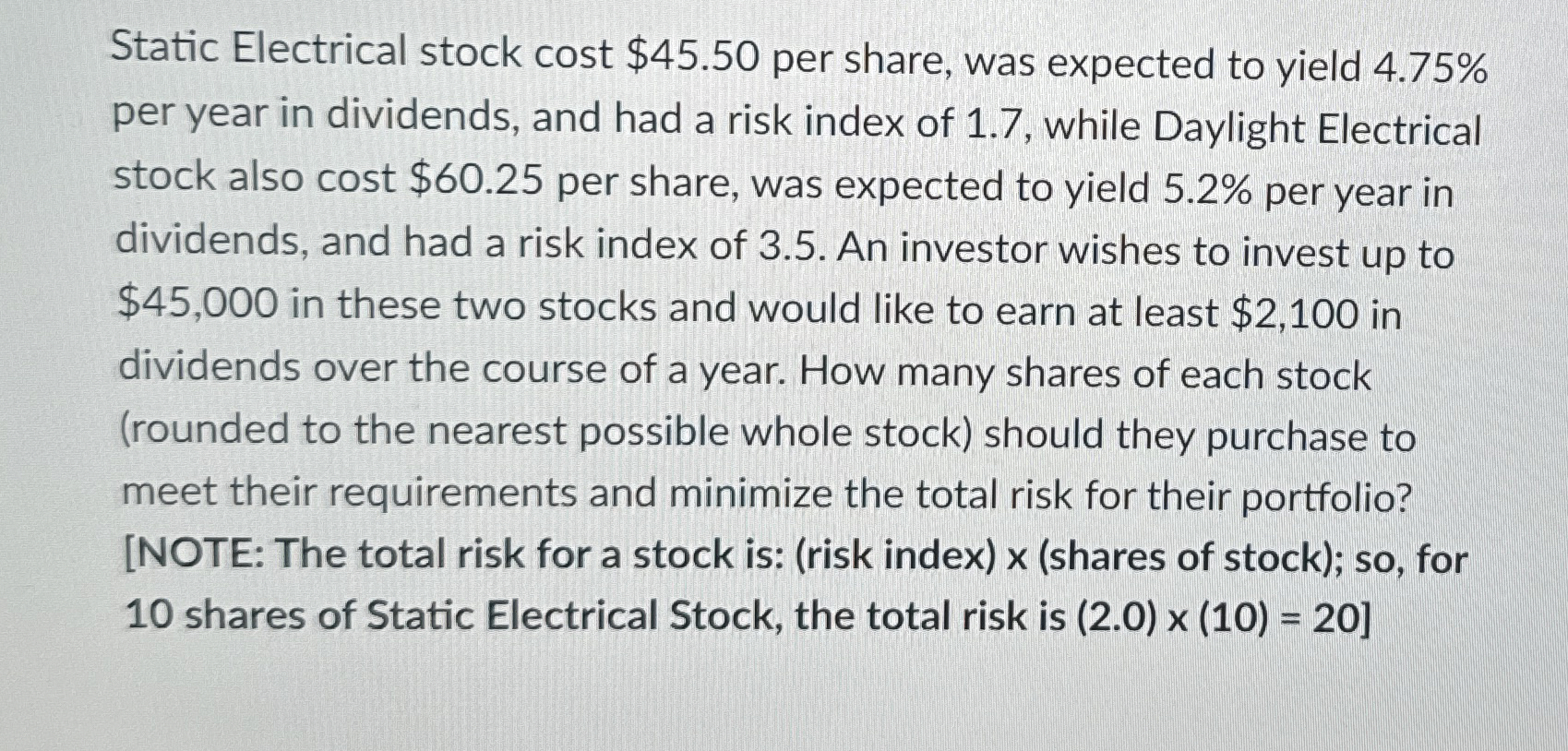

Question: Static Electrical stock cost $ 4 5 . 5 0 per share, was expected to yield 4 . 7 5 % per year in dividends,

Static Electrical stock cost $ per share, was expected to yield

per year in dividends, and had a risk index of while Daylight Electrical

stock also cost $ per share, was expected to yield per year in

dividends, and had a risk index of An investor wishes to invest up to

$ in these two stocks and would like to earn at least $ in

dividends over the course of a year. How many shares of each stock

rounded to the nearest possible whole stock should they purchase to

meet their requirements and minimize the total risk for their portfolio?

NOTE: The total risk for a stock is: risk index x shares of stock; so for

shares of Static Electrical Stock, the total risk is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock