Question: Steaks Galore needs to arrange financing for its expansion program. One bank offers to lend the required $1,000,000 on a loan which requires interest to

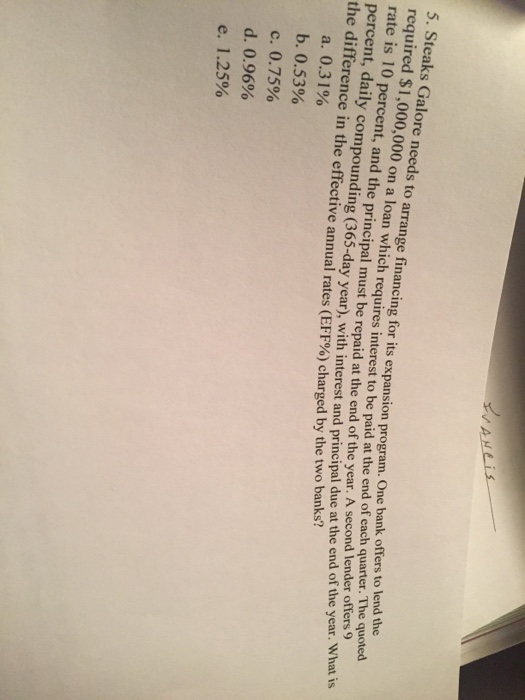

Steaks Galore needs to arrange financing for its expansion program. One bank offers to lend the required $1,000,000 on a loan which requires interest to be paid at the end of each quarter. The quoted rate is 10 percent, and the principal must be repaid at the end of the year. A second lender offers 9 percent, daily compounding (365-day year), with interest and principal due at the end of the year. What is the difference in the effective annual rates (EFF%) charged by the two banks? 0.31% 0.53% 0.75% 0.96% 1.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts