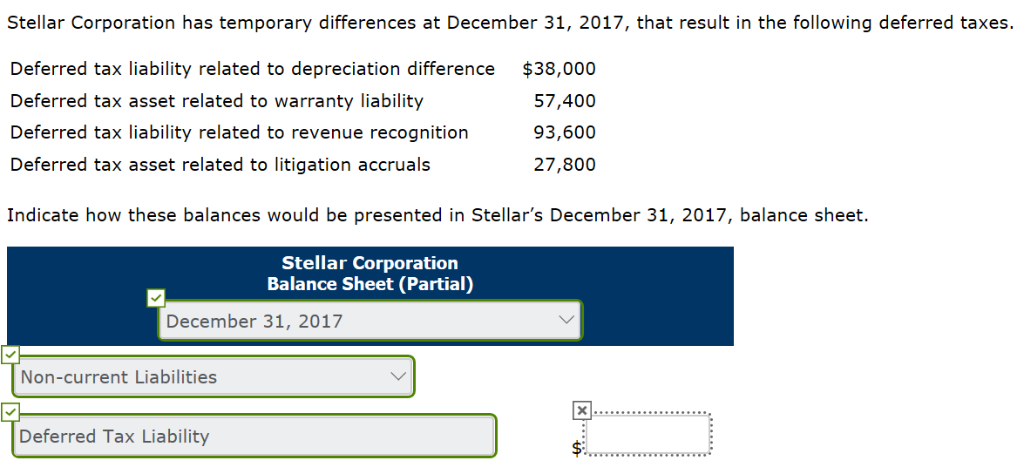

Question: Stellar Corporation has temporary differences at December 31, 2017, that result in the following deferred taxes Deferred tax liability related to depreciation difference $38,000 Deferred

Stellar Corporation has temporary differences at December 31, 2017, that result in the following deferred taxes Deferred tax liability related to depreciation difference $38,000 Deferred tax asset related to warranty liability Deferred tax liability related to revenue recognition Deferred tax asset related to litigation accruals 57,400 93,600 27,800 Indicate how these balances would be presented in Stellar's December 31, 2017, balance sheet. Stellar Corporation Balance Sheet (Partial) December 31, 2017 Non-current Liabilities Deferred Tax Liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts