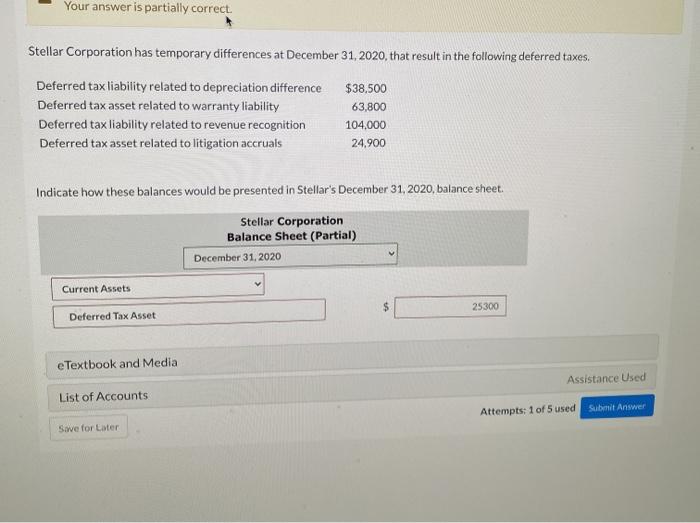

Question: Your answer is partially correct Stellar Corporation has temporary differences at December 31, 2020, that result in the following deferred taxes. Deferred tax liability related

Your answer is partially correct Stellar Corporation has temporary differences at December 31, 2020, that result in the following deferred taxes. Deferred tax liability related to depreciation difference $38,500 Deferred tax asset related to warranty liability 63,800 Deferred tax liability related to revenue recognition 104.000 Deferred tax asset related to litigation accruals 24,900 Indicate how these balances would be presented in Stellar's December 31, 2020, balance sheet. Stellar Corporation Balance Sheet (Partial) December 31, 2020 Current Assets 25300 Deferred Tax Asset e Textbook and Media Assistance Used List of Accounts Attempts: 1 of 5 used Submit Answer Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts