Question: Step 1 From the comparative balance sheets, determine the increase in cash and cash equivalents during the year. Step 2 Prepare a T-account to show

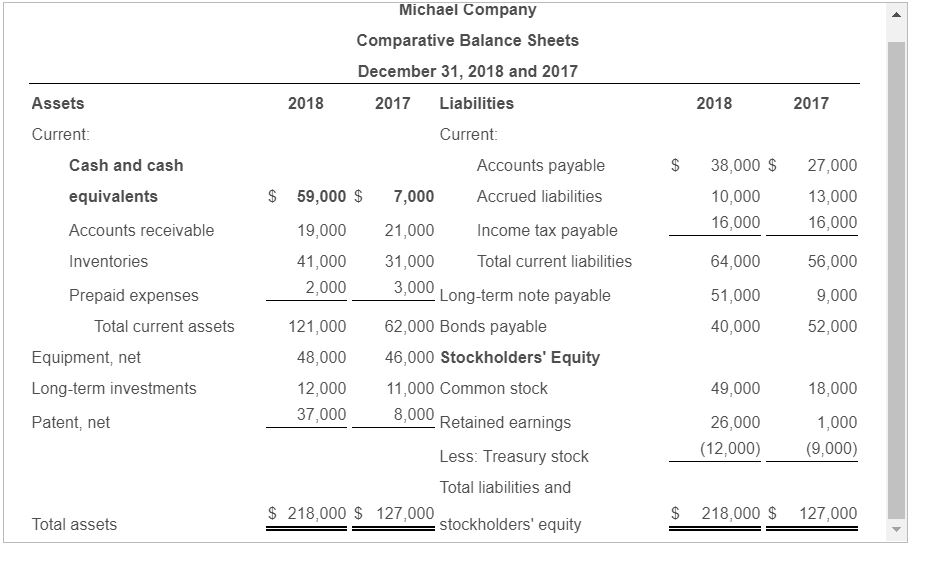

| Step 1 | From the comparative balance sheets, determine the increase in cash and cash equivalents during the year. |

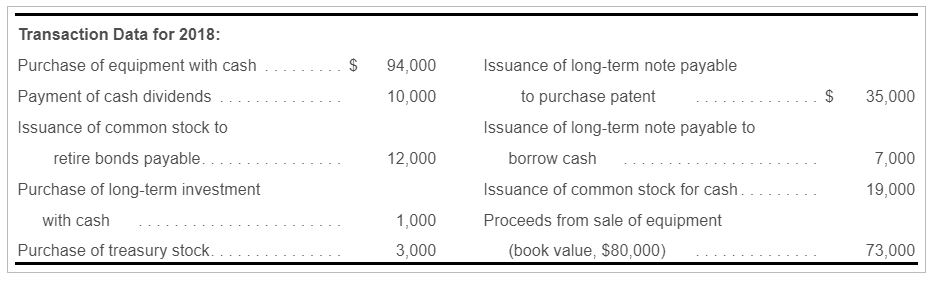

| Step 2 | Prepare a T-account to show the transaction activity in each long-term balance-sheet account. |

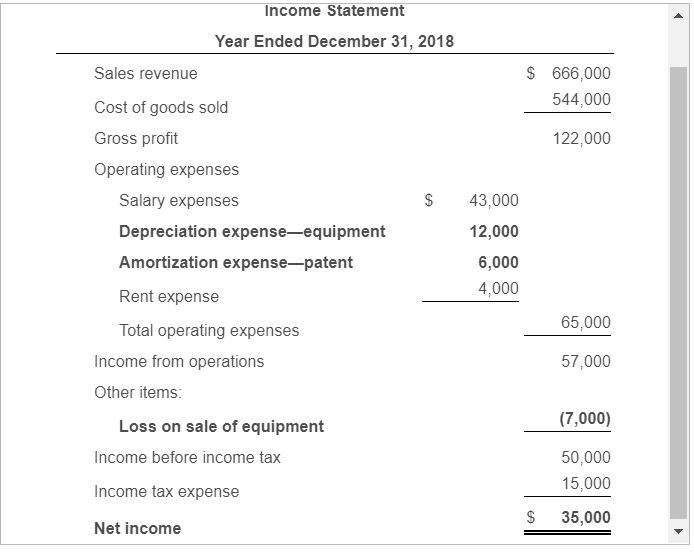

| Step 3 | Complete the statement of cash flows. From the income statement, take net income, depreciation, amortization, and the loss on sale of equipment to the statement of cash flows. Account for the year-to-year change in each balance sheet account. |

Income Statement Year Ended December 31, 2018 $666,000 Sales revenue 544,000 Cost of goods sold Gross profit 122,000 Operating expenses Salary expenses 43,000 Depreciation expense-equipment 12,000 Amortization expense-patent 6,000 4,000 Rent expense 65,000 Total operating expenses 57,000 Income from operations Other items: (7,000) Loss on sale of equipment Income before income tax 50,000 15,000 Income tax expense 35,000 Net income Michael Company Comparative Balance Sheets December 31, 2018 and 2017 Assets 2018 2017 Liabilities 2018 2017 Current: Current: Cash and cash Accounts payable $ 38,000 $ 27,000 $ 59,000 $ 7,000 equivalents Accrued liabilities 10,000 13,000 16,000 16,000 Accounts receivable Income tax payable 19,000 21,000 56,000 Inventories 41,000 31,000 Total current liabilities 64,000 3,000 Long-term note payable 2,000 Prepaid expenses 9,000 51,000 Total current assets 40,000 52,000 121,000 62,000 Bonds payable Equipment, net 48,000 46,000 Stockholders' Equity Long-term investments 12,000 11,000 Common stock 49,000 18,000 8,000 Retained earnings 37,000 Patent, net 26,000 1,000 (9,000) (12,000) Less: Treasury stock Total liabilities and $ 218,000 $ 127,000 stockholders' equity $ 218,000 $ 127,000 Total assets Transaction Data for 2018: Purchase of equipment with cash Issuance of long-term note payable 94,000 to purchase patent Payment of cash dividends 10,000 35,000 Issuance of common stock to Issuance of long-term note payable to retire bonds payable.. borrow cash 12,000 7,000 Purchase of long-term investment Issuance of common stock for cash 19,000 Proceeds from sale of equipment with cash 1,000 Purchase of treas ury stock 3,000 (book value, $80,000) 73,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts