Question: Step 1: Interpret a records retention schedule to identify appropriate destruction dates: 1. Refer to Figure 7.6 on p. 162 of our textbook to determine

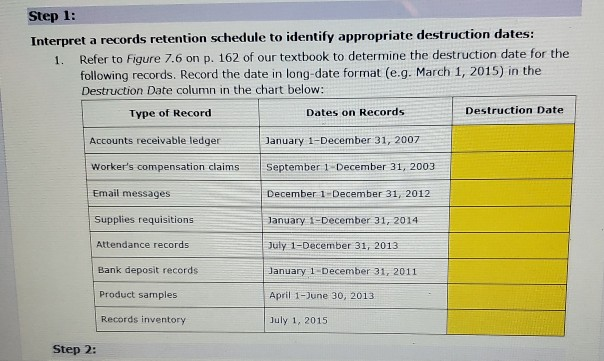

Step 1: Interpret a records retention schedule to identify appropriate destruction dates: 1. Refer to Figure 7.6 on p. 162 of our textbook to determine the destruction date for the following records. Record the date in long-date format (e.g. March 1, 2015) in the Destruction Date column in the chart below: Type of Record Dates on Records Destruction Date Accounts receivable ledger January 1-December 31, 2007 Worker's compensation claims September 1 December 31, 2003 Email messages December 1-December 31, 2012 Supplies requisitions January 1-December 31, 2014 Attendance records July 1-December 31, 2013 Bank deposit records January 1 December 31, 2011 Product samples April 1- June 30, 2013 Records inventory July 1, 2015 Step 2: Step 1: Interpret a records retention schedule to identify appropriate destruction dates: 1. Refer to Figure 7.6 on p. 162 of our textbook to determine the destruction date for the following records. Record the date in long-date format (e.g. March 1, 2015) in the Destruction Date column in the chart below: Type of Record Dates on Records Destruction Date Accounts receivable ledger January 1-December 31, 2007 Worker's compensation claims September 1 December 31, 2003 Email messages December 1-December 31, 2012 Supplies requisitions January 1-December 31, 2014 Attendance records July 1-December 31, 2013 Bank deposit records January 1 December 31, 2011 Product samples April 1- June 30, 2013 Records inventory July 1, 2015 Step 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts