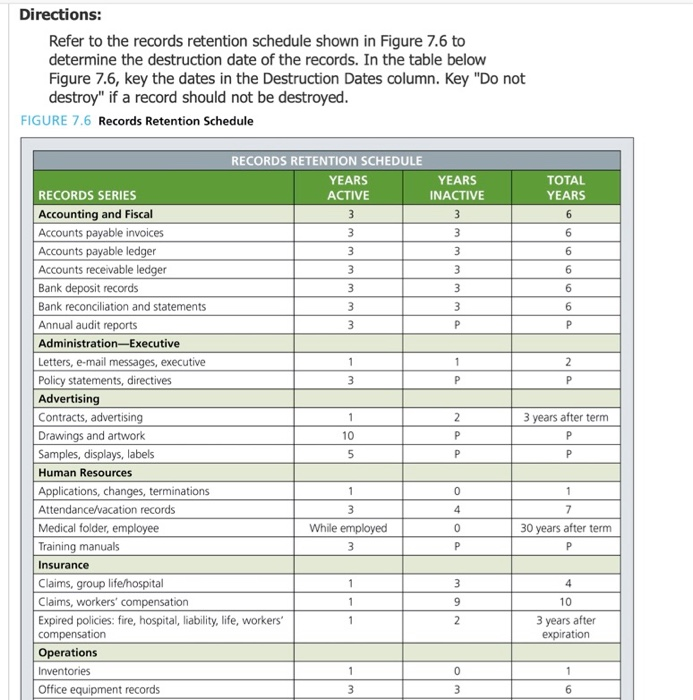

Question: To answer the questions in steps 1-10, you will need to reference Figure 1, the Records Retention Schedule below (which is Figure 7.6 in your

To answer the questions in steps 1-10, you will need to reference Figure 1, the Records Retention Schedule below (which is Figure 7.6 in your textbook).

Open the Records Retention Schedule table in Datasheet view and update the fields in each database record based on the information in Figure 1, as described in the directions that follow Figure 1.

Figure 1

Directions: Refer to the records retention schedule shown in Figure 7.6 to determine the destruction date of the records. In the table below Figure 7.6, key the dates in the Destruction Dates column. Key "Do not destroy" if a record should not be destroyed. FIGURE 7.6 Records Retention Schedule RECORDS RETENTION SCHEDULE YEARS YEARS TOTAL RECORDS SERIES ACTIVE INACTIVE YEARS Accounting and Fiscal 3 3 Accounts payable ledger 3 W W W W W 6 Accounts payable invoices 3 6 3 6 Accounts receivable ledger 6 Bank deposit records W 6 Bank reconciliation and statements w w 6 Annual audit reports Administration-Executive Letters, e-mail messages, executive Policy statements, directives w D - Advertising Contracts, advertising 3 years after term Drawings and artwork 10 P Samples, displays, labels 5 P Human Resources Applications, changes, terminations - 0 Attendance/vacation records 3 7 Medical folder, employee While employed 0 30 years after term Training manuals 3 P Insurance Claims, group life/hospital 1 NN LO W 4 Claims, workers' compensation 1 10 Expired policies: fire, hospital, liability, life, workers' 1 3 years after compensation expiration Operations Inventories - Office equipment records 3 W O 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts