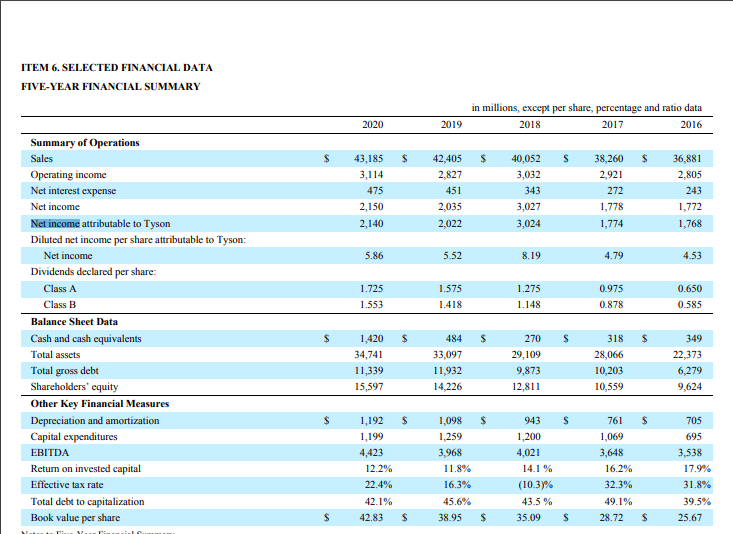

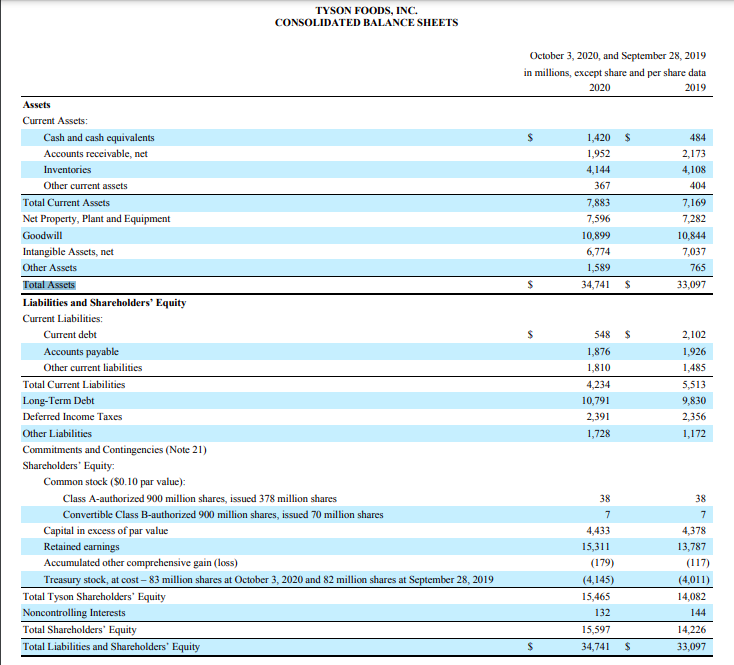

Question: Step 1: perform a ratio analysis that includes ROA; ROE; Debt/Assets and any other financial ratio you deem important. Step 2: perform another ratio analysis

Step 1: perform a ratio analysis that includes ROA; ROE; Debt/Assets and any other financial ratio you deem important.

Step 2: perform another ratio analysis with the same ratios except you need to adjust for Goodwill as set forth in the Home Depot Financial Story presentation.

Step 3: you need to discuss the revised ratio computations in Step 2 compared to Step 1. Please be sure to include any insights and related thoughts rather than just noting the differences in your computations. We are always taught the importance of the financial ratio analysis and the related insights derived; however, the revised ratio analysis you perform in Step 2 may yield additional insights into the organization. As a strategist, it is important to go beyond the standard analysis. As a business professional your thoughts and insights are important.

ITEM 6. SELECTED FINANCIAL DATA FIVE-YEAR FINANCIAL SUMMARY TYSON FOODS, INC. CONSOLIDATED BALANCE SHEETS October3,2020,andSeptember28,2019inmillions,exceptshareandpersharedata2020 Assets Current Assets: \begin{tabular}{l} Cash and cash equivalents \\ Accounts receivable, net \\ Inventories \\ Other current assets \\ \hline Total Current Assets \\ Net Property, Plant and Equipment \\ Goodwill \\ Intangible Assets, net \\ Other Assets \\ \hline Total Assets \\ \hline Liabilities and Shareholders' Equity \\ Current Liabilities: \\ Current debt \\ Accounts payable \\ Other current liabilities \\ \hline Total Current Liabilities \\ Long-Term Debt \\ Deferred Income Taxes \\ Other Liabilities \\ Commitments and Contingencies (Note 21) \end{tabular} Shareholders' Equity: Common stock (\$0.10 par value)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts