Question: Step 1 Step 2 Step 3 Read the entire assignment. Compute contribution amounts and Future Values for all accounts. Compute the amount of each future

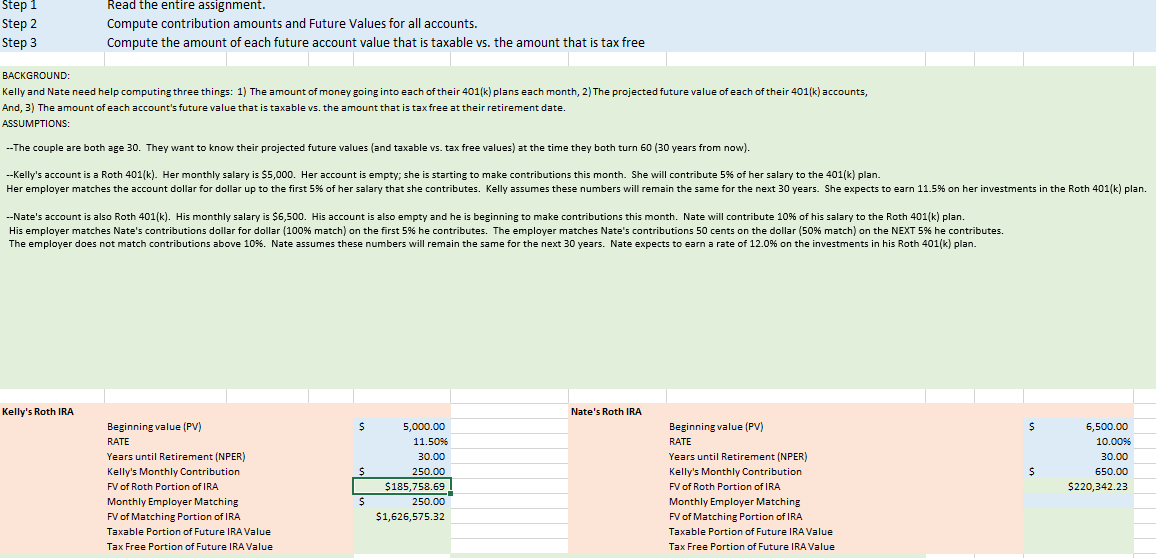

Step 1 Step 2 Step 3 Read the entire assignment. Compute contribution amounts and Future Values for all accounts. Compute the amount of each future account value that is taxable vs. the amount that is tax free BACKGROUND: Kelly and Nate need help computing three things: 1) The amount of money going into each of their 401(k) plans each month, 2) The projected future value of each of their 401(k) accounts, And, 3) The amount of each account's future value that is taxable vs. the amount that is tax free at their retirement date. ASSUMPTIONS: : --The couple are both age 30. They want to know their projected future values (and taxable vs. tax free values) at the time they both turn 60 (30 years from now). --Kelly's account is a Roth 401(k). Her monthly salary is $5,000. Her account is empty; she is starting to make contributions this month. She will contribute 5% of her salary to the 401(k) plan. Her employer matches the account dollar for dollar up to the first 5% of her salary that she contributes. Kelly assumes these numbers will remain the same for the next 30 years. She expects to earn 11.5% on her investments in the Roth 401(k) plan. --Nate's account also Roth 401(k). His monthly salary is $6,500. His account is also empty and he is beginning to make contributions this month. Nate will contribute 10% of his salary to the Roth 401(k) plan His employer matches Nate's contributions dollar for dollar (100% match) on the first 5% he contributes. The employer matches Nate's contributions 50 cents on the dollar (50% match) on the NEXT 5% he contributes. The employer does not match contributions above 10%. Nate assumes these numbers will remain the same for the next 30 years. Nate expects to earn a rate of 12.0% on the investments in his Roth 401(k) plan. Kelly's Roth IRA Nate's Roth IRA $ $ $ Beginning value (PV) RATE Years until Retirement (NPER) Kelly's Monthly Contribution FV of Roth Portion of IRA Monthly Employer Matching FV of Matching portion of IRA Taxable Portion of Future IRA Value Tax Free Portion of Future IRA Value 5,000.00 11.5096 30.00 250.00 $185,758.69 250.00 $1,626,575.32 6,500.00 10.0096 30.00 650.00 $220,342.23 $ Beginning value (PV) RATE Years until Retirement (NPER) Kelly's Monthly Contribution FV of Roth Portion of IRA Monthly Employer Matching FV of Matching portion of IRA Taxable Portion of Future IRA Value Tax Free Portion of Future IRA Value $ Step 1 Step 2 Step 3 Read the entire assignment. Compute contribution amounts and Future Values for all accounts. Compute the amount of each future account value that is taxable vs. the amount that is tax free BACKGROUND: Kelly and Nate need help computing three things: 1) The amount of money going into each of their 401(k) plans each month, 2) The projected future value of each of their 401(k) accounts, And, 3) The amount of each account's future value that is taxable vs. the amount that is tax free at their retirement date. ASSUMPTIONS: : --The couple are both age 30. They want to know their projected future values (and taxable vs. tax free values) at the time they both turn 60 (30 years from now). --Kelly's account is a Roth 401(k). Her monthly salary is $5,000. Her account is empty; she is starting to make contributions this month. She will contribute 5% of her salary to the 401(k) plan. Her employer matches the account dollar for dollar up to the first 5% of her salary that she contributes. Kelly assumes these numbers will remain the same for the next 30 years. She expects to earn 11.5% on her investments in the Roth 401(k) plan. --Nate's account also Roth 401(k). His monthly salary is $6,500. His account is also empty and he is beginning to make contributions this month. Nate will contribute 10% of his salary to the Roth 401(k) plan His employer matches Nate's contributions dollar for dollar (100% match) on the first 5% he contributes. The employer matches Nate's contributions 50 cents on the dollar (50% match) on the NEXT 5% he contributes. The employer does not match contributions above 10%. Nate assumes these numbers will remain the same for the next 30 years. Nate expects to earn a rate of 12.0% on the investments in his Roth 401(k) plan. Kelly's Roth IRA Nate's Roth IRA $ $ $ Beginning value (PV) RATE Years until Retirement (NPER) Kelly's Monthly Contribution FV of Roth Portion of IRA Monthly Employer Matching FV of Matching portion of IRA Taxable Portion of Future IRA Value Tax Free Portion of Future IRA Value 5,000.00 11.5096 30.00 250.00 $185,758.69 250.00 $1,626,575.32 6,500.00 10.0096 30.00 650.00 $220,342.23 $ Beginning value (PV) RATE Years until Retirement (NPER) Kelly's Monthly Contribution FV of Roth Portion of IRA Monthly Employer Matching FV of Matching portion of IRA Taxable Portion of Future IRA Value Tax Free Portion of Future IRA Value $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts