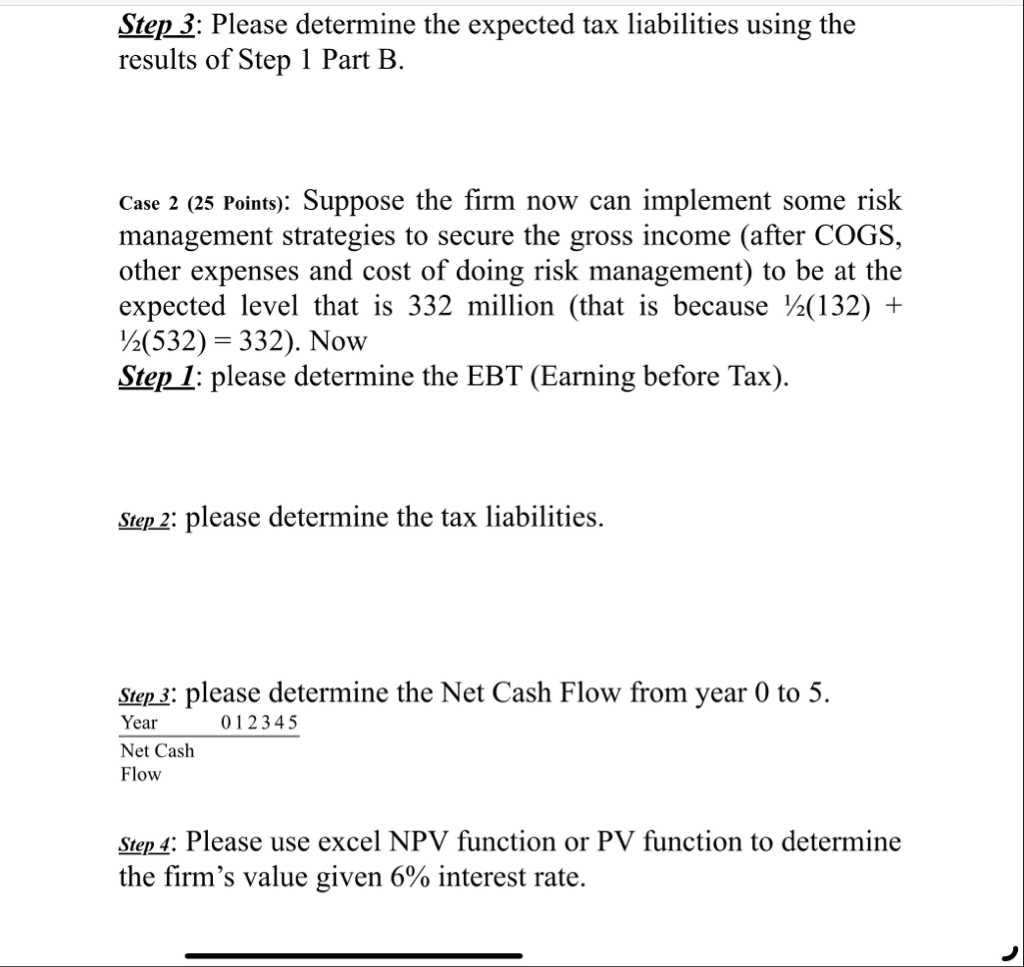

Question: Step 3 : Please determine the expected tax liabilities using the results of Step 1 Part B . Case 2 ( 2 5 Points )

Step : Please determine the expected tax liabilities using the results of Step Part B

Case Points: Suppose the firm now can implement some risk management strategies to secure the gross income after COGS, other expenses and cost of doing risk management to be at the expected level that is million that is because Now

Step : please determine the EBT Earning before Tax

Step : please determine the tax liabilities.

Step : please determine the Net Cash Flow from year to

Year

Net Cash

Flow

Step : Please use excel NPV function or PV function to determine the firm's value given interest rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock