Question: step by step for part B & C please! Required information [The following information applies to the questions displayed below] Lone Star Company is a

![following information applies to the questions displayed below] Lone Star Company is](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e597e7b8b99_66366e597e75a080.jpg)

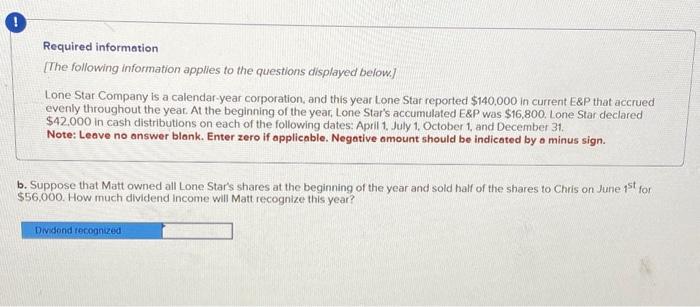

Required information [The following information applies to the questions displayed below] Lone Star Company is a calendar-year corporation, and this year Lone Star reported $140,000 in current E\&P that accrued evenly throughout the year. At the beginning of the year, Lone Star's accumulated E\&P was $16,800. Lone Star declared $42.000 in cash distributions on each of the following dates: April 1, July 1, October 1, and December 31 . Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. . Suppose that Matt owned all Lone Star's shares at the beginning of the year and sold half of the shares to Chris on June 1st for 56,000 . How much dividend income will Matt recognize this year? Required information [The following information applies to the questions displayed below] Lone Star Company is a calendar-year corporation, and this year Lone Star reported $140,000 in current E\&P that accrued evenly throughout the year. At the beginning of the yeat, Lone Star's accumulated E\&P was $16,800. Lone Star declared $42,000 in cash distributions on each of the following dates: April 1 , July 1, October 1 , and December 31. Note: Leave no onswer blank. Enter zero if applicable. Negative omount should be indicated by a minus sign. If Matt's basis in the Lone Star shares was $9,800 at the beginning of the year, how much capital gain will he recognize on the sale nd distributions from Lone Star? Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts