Question: step by step no ne evaluating projects that are in the $2.10. A flotation grow SPREADSHEET PROBLEM (9-18) Start with the partial model in the

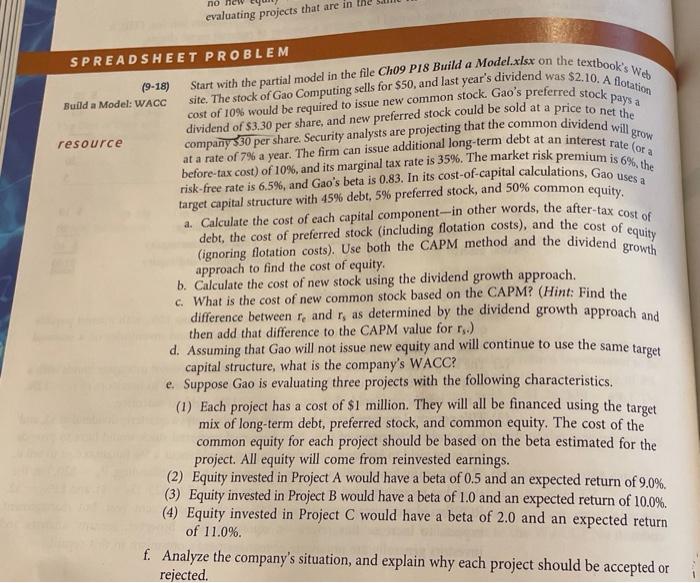

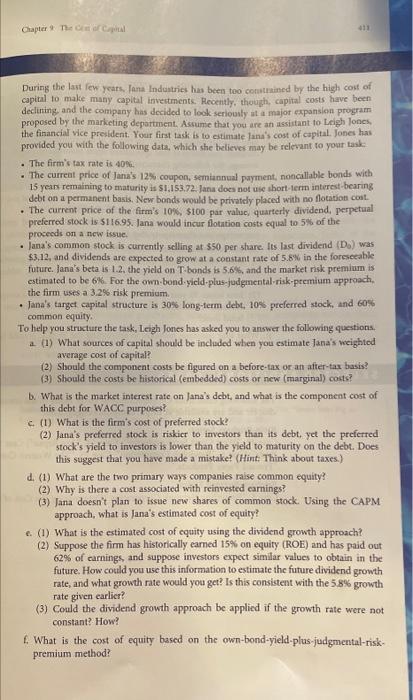

no ne evaluating projects that are in the $2.10. A flotation grow SPREADSHEET PROBLEM (9-18) Start with the partial model in the file Ch09 P18 Build a Model.xlsx on the textbook's Web Build a Model: WACC site. The stock of Gao Computing sells for $50, and last year's dividend was dividend of $3.30 per share, and new preferred stock could be sold at a price to net the resource at a rate of 7% a year. The firm can issue additional long-term debt at an interest rate of a company 30 per share. Security analysts are projecting that the common dividend will before-tax cost) of 10%, and its marginal tax rate is 35%. The market risk premium is 6%, the risk-free rate is 6.5%, and Gao's beta is 0.83. In its cost-of-capital calculations, Gao uses the target capital structure with 45% debt, 5% preferred stock, and 50% common equity. a. Calculate the cost of each capital component-in other words, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). Use both the CAPM method and the dividend growth approach to find the cost of equity. b. Calculate the cost of new stock using the dividend growth approach. c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between r, and r, as determined by the dividend growth approach and then add that difference to the CAPM value for rs.) d. Assuming that Gao will not issue new equity and will continue to use the same target capital structure, what is the company's WACC? e. Suppose Gao is evaluating three projects with the following characteristics. (1) Each project has a cost of $1 million. They will all be financed using the target mix of long-term debt, preferred stock, and common equity. The cost of the common equity for each project should be based on the beta estimated for the project. All equity will come from reinvested earnings. (2) Equity invested in Project A would have a beta of 0.5 and an expected return of 9.0%. (3) Equity invested in Project B would have a beta of 1.0 and an expected return of 10.0% (4) Equity invested in Project C would have a beta of 2.0 and an expected return of 11.0%. f. Analyze the company's situation, and explain why each project should be accepted or rejected. Ohapter not repital 11 - During the last few years, Jana Industries has been too contined by the high cost of capital to make many capital investments. Recently though, capital costs have been declining, and the company has decided to look seriously ut a major expansion program proposed by the marketing department. Assume that you are an assistant to Leigh Jones the financial vice president. Your first task is to estimate Jana's cost of capital. Jones has provided you with the following data, which she believes may be relevant to your task . The firm's tax rate is 40. The current price of Jana's 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1.153.72. Jana does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation col. . The current price of the firm's 10%, $100 par value, quarterly dividend, perpetual preferred stock is $11695. Jana would incur flotation costs equal to 5% of the proceeds on a new issue Jana's common stock is currently selling at $50 per share. Its last dividend (D) was $3,12, and dividends are expected to grow at a constant rate of 5.8% in the foreseeable future. Jana's beta is 1.2. the yield on T-bonds is 5.6%, and the market risk premium is estimated to be 6%. For the own-bond-yield-plus-fudgmental-risk-premium approach the firm uses a 3.2% risk premium Jane's target capital structure is 30% long-term debt, 10% preferred stock, and 60% common equity To help you structure the task. Leigh Jones has asked you to answer the following questions 2 () What sources of capital should be included when you estimate Jana's weighted average cost of capital? (2) Should the component costs be figured on a before tax or an after-tax basis? (3) Should the costs be historical (embedded) costs or new (marginal) costs? b. What is the market interest rate on Jana's debt, and what is the component cost of this debt for WACC purposes! c (1) What is the firm's cost of preferred stock? (2) Jana's preferred stock is riskier to investors than its debt, yet the preferred stock's yield to investors is lower than the yield to maturity on the debt. Does this suggest that you have made a mistake? (Hint: Think about taxes.) d. (1) What are the two primary ways companies raise common equity? (2) Why is there a cost associated with reinvested earnings? (3) Jana doesn't plan to issue new shares of common stock. Using the CAPM approach, what is Jana's estimated cost of equity? 6. (1) What is the estimated cost of cquity using the dividend growth approach? (2) Suppose the firm has historically earned 15% on equity (ROE) and has paid out 62% of carnings, and suppose investors expect similar values to obtain in the future. How could you use this information to estimate the future dividend growth rate, and what growth rate would you get? Is this consistent with the 5.8% growth rate given earlier? (3) Could the dividend growth approach be applied if the growth rate were not constant? How? 1. What is the cost of equity based on the own-bond-yield-plus-judgmental-risk- premium method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts