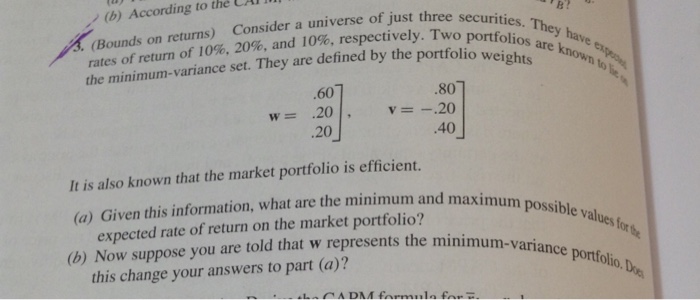

Question: Step by step please and include formulas. Thank you (b) According to th CAI (Bounds on returns) the minimum-variance set. They are defined by the

(b) According to th CAI (Bounds on returns) the minimum-variance set. They are defined by the portfolio rates of return of 10%, 20% and 10%,respectively. Two portfoes. They 60 .20 Consider a universe of just three s tively. Two portfolios are weights .801 .201, 20 w= .40 It is also known that the market portfolio is efficient. (a) Given this information, what are the minimum and maximum possible values for expected rate of return on the market portfolio? represents the minimum-variance (b) Now suppose you are told that w portfolio. D this change your answers to part (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts