Question: step by step process. I need to get the financial leverage Gross profit ratio Operating Profit Ratio Net Profit margin and the Zscore Using the

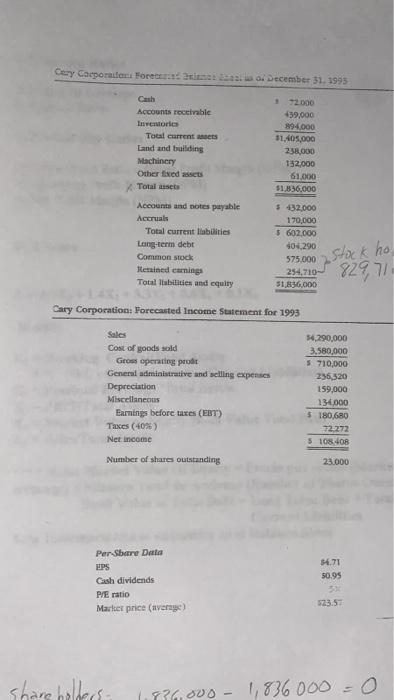

Cery Corporate Forecast December 31. 1995 Accounts receivable Inventore Total current acts Land and building Machinery Other Exed assets Total asset 2000 39,000 894.000 11.405,000 238.000 132,000 61,000 51,836,000 Accounts and notes payable Accrual Total current liabilities Long-term debt Common stock Metained coming Total Itabilities and equity 5432.000 170,000 $ 602.000 104.290 575.000 254,710- 51836.000 Stock ho 82971 Cary Corporation: Forecasted Income Sustement for 1993 Sales Cost of yoods sold Gross operating prodt General administrative and selling expenses Depreciation Miscellaneous Earnings before taxes (ERT) Taxes (40%) Net Income 54.290,000 3.580,000 5 710,000 236,320 159,000 134.000 $ 180,680 72272 5 10:08 Number of shares outstanding 23.000 54.71 50.95 Per Sbare Data EPS Gash dividends P/E ratio Market price (average) 523.57 shareholders 936.000 1,836000 =0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts