Question: Step by step solution needed to obtain the answer thanks A government bond is redeemable at 113% in exactly 11 years. The coupon rate is

Step by step solution needed to obtain the answer thanks

Step by step solution needed to obtain the answer thanks

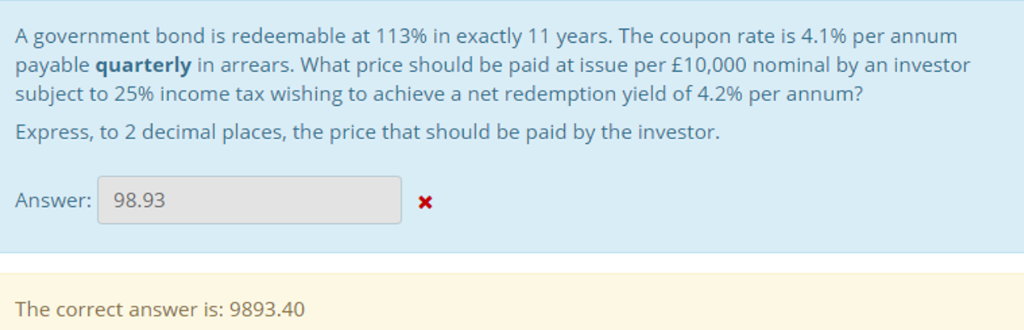

A government bond is redeemable at 113% in exactly 11 years. The coupon rate is 4.1% per annum payable quarterly in arrears. What price should be paid at issue per 10,000 nominal by an investor subject to 25% income tax wishing to achieve a net redemption yield of 4.2% per annum? Express, to 2 decimal places, the price that should be paid by the investor. Answer: 98.93 The correct answer is: 9893.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts