Question: Step by step solution needed to obtain the answer, thanks :) In January 2003, the government of a country issued an index-linked bond redeemable at

Step by step solution needed to obtain the answer, thanks :)

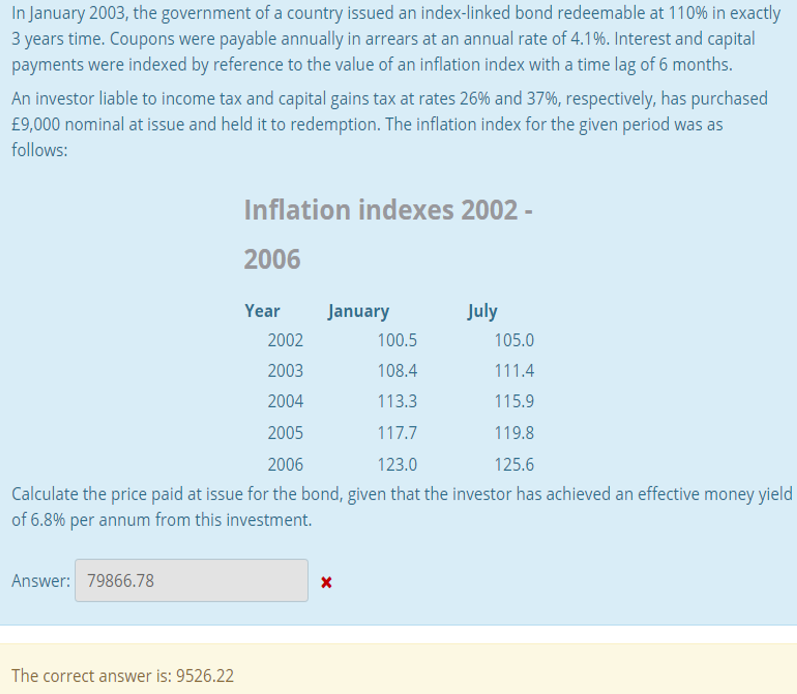

In January 2003, the government of a country issued an index-linked bond redeemable at 110% in exactly 3 years time. Coupons were payable annually in arrears at an annual rate of 4.196. Interest and capital payments were indexed by reference to the value of an inflation index with a time lag of 6 months. An investor liable to income tax and capital gains tax at rates 26% and 37%, respectively, has purchased 9,000 nominal at issue and held it to redemption. The inflation index for the given period was as follows: Inflation indexes 2002- 2006 July Year January 2002 100.5 105.0 2003 108.4 111.4 2004 113.3 115.9 2005 117.7 119.8 125.6 2006 123.0 Calculate the price paid at issue for the bond, given that the investor has achieved an effective money yield of 6.8% per annum from this investment. Answer: 79866.78 X The correct answer is: 9526.22 In January 2003, the government of a country issued an index-linked bond redeemable at 110% in exactly 3 years time. Coupons were payable annually in arrears at an annual rate of 4.196. Interest and capital payments were indexed by reference to the value of an inflation index with a time lag of 6 months. An investor liable to income tax and capital gains tax at rates 26% and 37%, respectively, has purchased 9,000 nominal at issue and held it to redemption. The inflation index for the given period was as follows: Inflation indexes 2002- 2006 July Year January 2002 100.5 105.0 2003 108.4 111.4 2004 113.3 115.9 2005 117.7 119.8 125.6 2006 123.0 Calculate the price paid at issue for the bond, given that the investor has achieved an effective money yield of 6.8% per annum from this investment. Answer: 79866.78 X The correct answer is: 9526.22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts