Question: Step by step solution required for these two questions Michelak's Maritime Industries has relatively stable carnings and pays an annual dividend of $3 per share.

Step by step solution required for these two questions

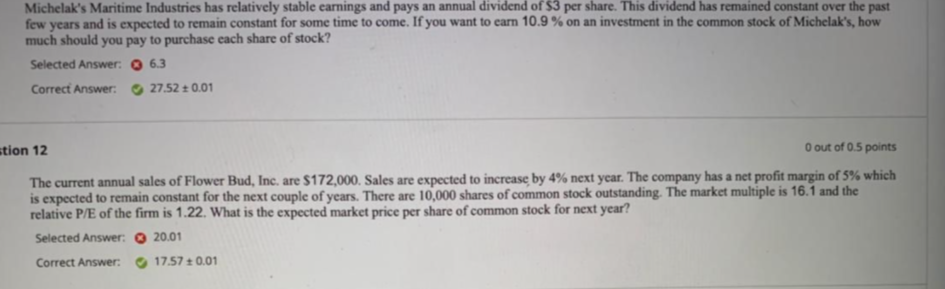

Michelak's Maritime Industries has relatively stable carnings and pays an annual dividend of $3 per share. This dividend has remained constant over the past few years and is expected to remain constant for some time to come. If you want to earn 10.9% on an investment in the common stock of Michelak's, how much should you pay to purchase each share of stock? Selected Answer: 6.3 Correct Answer: 27.52 +0.01 tion 12 O out of 0.5 points The current annual sales of Flower Bud, Inc. are $172,000. Sales are expected to increase by 4% next year. The company has a net profit margin of 5% which is expected to remain constant for the next couple of years. There are 10,000 shares of common stock outstanding. The market multiple is 16.1 and the relative P/E of the firm is 1.22. What is the expected market price per share of common stock for next year? Selected Answer: 20.01 Correct Answer: 17.57 +0.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts