Question: Step by step solution would be grateful for each part thanks The following 3 questions relate to S plc and the information given below: 240p

Step by step solution would be grateful for each part thanks

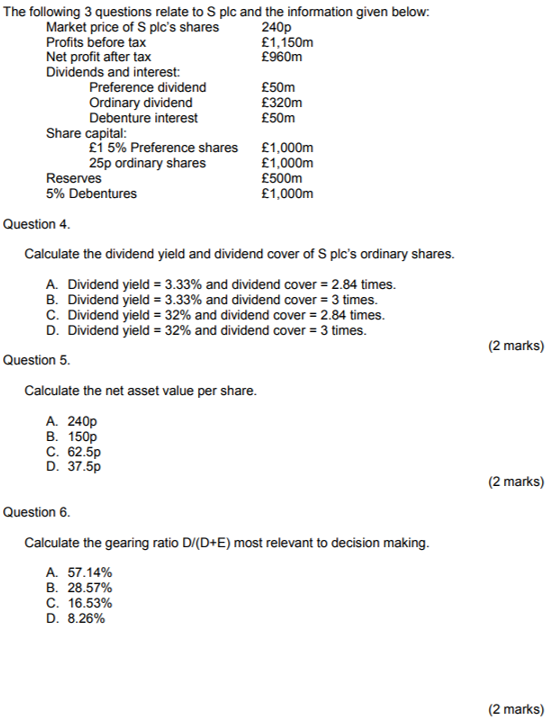

The following 3 questions relate to S plc and the information given below: 240p 1,150m 960m Market price of S plc's shares Profits before tax Net profit after tax Dividends and interest: 50m 320m 50m Preference dividend Ordinary dividend Debenture interest Share capital 15% Preference shares 25p ordinary shares 1.000m 1,000m 500m 1,000m Reserves 5% Debentures Question 4 Calculate the dividend yield and dividend cover of S plc's ordinary shares. A. B. C. D. Dividend yield Dividend yield Dividend yield Dividend yield 3.33% and dividend cover-2.84 times. 3.33% and dividend cover: 3 times. 32% and dividend cover: 284 times. 32% and dividend cover: 3 times (2 marks) Question 5. Calculate the net asset value per share A. 240p B. 150p C. 62.5p D. 37.5p (2 marks) Question 6 Calculate the gearing ratio DI(D+E) most relevant to decision making A. 57.14% B. 28.57% C. 16.53% D. 8.26% (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts