Question: Step by step solution would be grateful thanks An individual is investing in a market where spot rates and forward rates apply. In this market,

Step by step solution would be grateful thanks

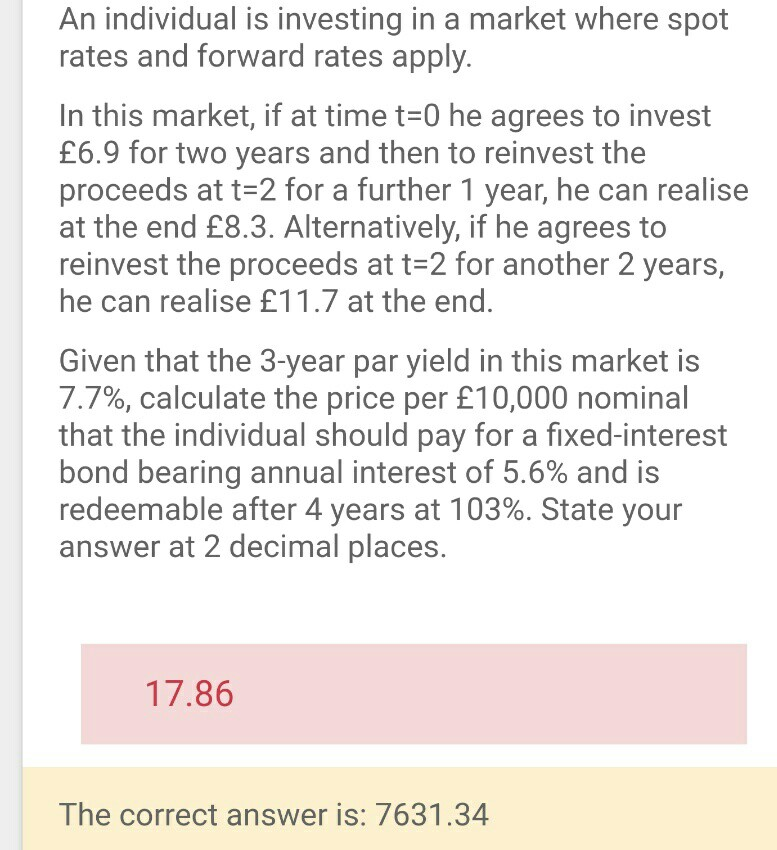

An individual is investing in a market where spot rates and forward rates apply. In this market, if at time t-0 he agrees to invest 6.9 for two years and then to reinvest the proceeds at t-2 for a further 1 year, he can realise at the end 8.3. Alternatively, if he agrees to reinvest the proceeds at t-2 for another 2 years, he can realise 11.7 at the end. Given that the 3-year par yield in this market is 7.7%, calculate the price per 10,000 nominal that the individual should pay for a fixed-interest bond bearing annual interest of 5.6% and is redeemable after 4 years at 103%. State your answer at 2 decimal places. 17.86 The correct answer is: 7631.34 An individual is investing in a market where spot rates and forward rates apply. In this market, if at time t-0 he agrees to invest 6.9 for two years and then to reinvest the proceeds at t-2 for a further 1 year, he can realise at the end 8.3. Alternatively, if he agrees to reinvest the proceeds at t-2 for another 2 years, he can realise 11.7 at the end. Given that the 3-year par yield in this market is 7.7%, calculate the price per 10,000 nominal that the individual should pay for a fixed-interest bond bearing annual interest of 5.6% and is redeemable after 4 years at 103%. State your answer at 2 decimal places. 17.86 The correct answer is: 7631.34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts