Question: Step by step solution would be grateful for each part thanks An individual is investing in a market where spot rates and forward rates apply.

Step by step solution would be grateful for each part thanks

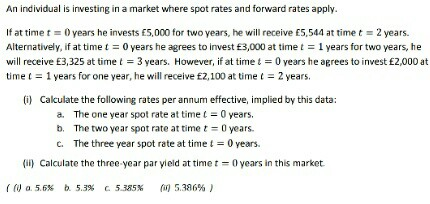

An individual is investing in a market where spot rates and forward rates apply. If at time t # 0 years he invests E5,000 for two years, he will receive E5.544 at time t 2 years. Alternatively, if at time t0 years he agrees to invest E3,000 at time t1 years for two years, he will receive 3,325 at time t = 3 years. However, if at time t = 0 years he agrees to invest 2,000 at time t 1 years for one year, he will receive 2,100 at time t 2 years. (i) Cakculate the following rates per annum effective, implied by this data: a. The one year spot rate at timet0 years b. The two year spot rate at time t 0 years c. The three year spot rate at time t = 0 years. (i) Calculate the three year par yield at timet0 years in this market ((i) a 5.5% b. 5.3% c. 5.385% (05386%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts