Question: Step by step solution would for each part would be amazing thanks In January 2000, the government of a country issued an index-linked bond redeemable

Step by step solution would for each part would be amazing thanks

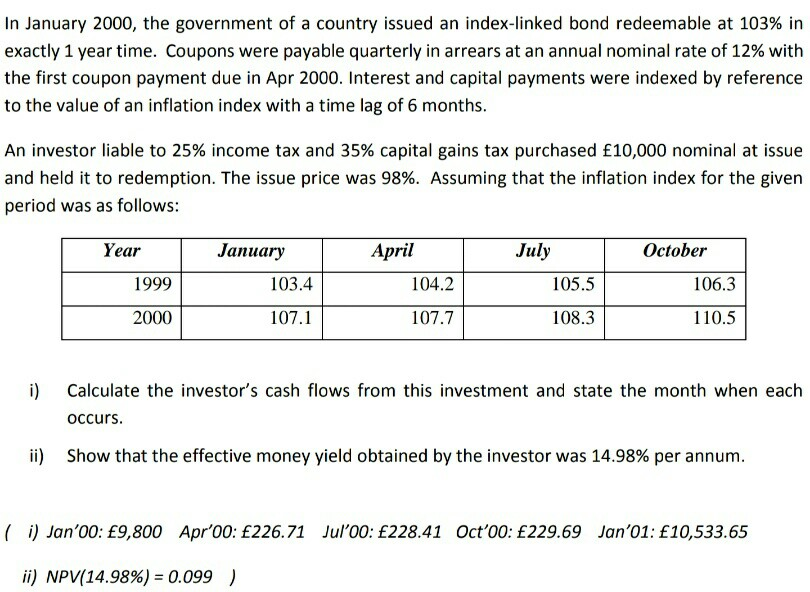

In January 2000, the government of a country issued an index-linked bond redeemable at 103% in exactly 1 year time. Coupons were payable quarterly in arrears at an annual nominal rate of 12% with the first coupon payment due in Apr 2000. Interest and capital payments were indexed by reference to the value of an inflation index with a time lag of 6 months. An investor liable to 25% income tax and 35% capital gains tax purchased 10,000 nominal at issue and held it to redemption. The issue price was 98%. Assuming that the inflation index for the given period was as follows: Year January April July October 1999 103.4 104.2 105.5 106.3 2000 107.1 107.7 108.3 110.5 i) Calculate the investor's cash flows from this investment and state the month when each occurs ii) Show that the effective money yield obtained by the investor was 14.98% per annum. (i) Jan'00: 9,800 Apr'00: 226.71 Jul'00: 228.41 Oct'00: 229.69 Jan'01: 10,533.65 ii) NPV(14.98%)-0.099 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts