Question: step by step thx Note: Correct answers to calculations-based questions will only be awarded full mark if clearly stated numerical formula (including the left-hand side

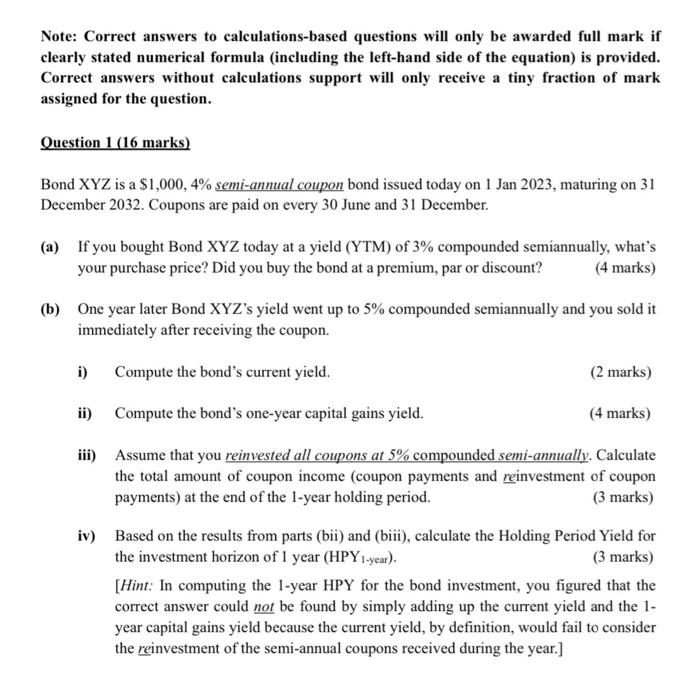

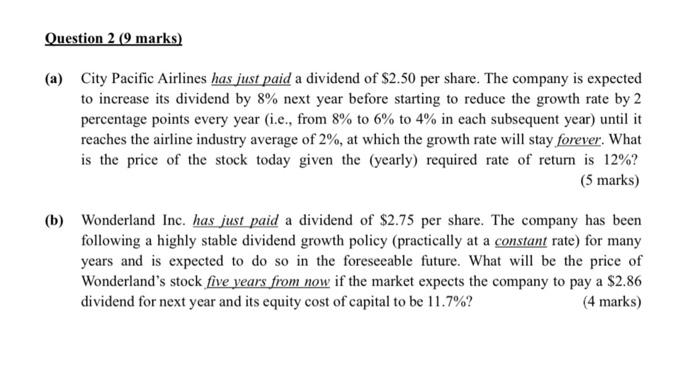

Note: Correct answers to calculations-based questions will only be awarded full mark if clearly stated numerical formula (including the left-hand side of the equation) is provided. Correct answers without calculations support will only receive a tiny fraction of mark assigned for the question. Question 1 (16 marks) Bond XYZ is a $1,000,4% semi-annual coupon bond issued today on 1 Jan 2023, maturing on 31 December 2032. Coupons are paid on every 30 June and 31 December. (a) If you bought Bond XYZ today at a yield (YTM) of 3% compounded semiannually, what's your purchase price? Did you buy the bond at a premium, par or discount? (4 marks) (b) One year later Bond XYZ's yield went up to 5% compounded semiannually and you sold it immediately after receiving the coupon. i) Compute the bond's current yield. (2 marks) ii) Compute the bond's one-year capital gains yield. (4 marks) iii) Assume that you reinvested all coupons at 5% compounded semi-annually. Calculate the total amount of coupon income (coupon payments and reinvestment of coupon payments) at the end of the 1-year holding period. (3 marks) iv) Based on the results from parts (bii) and (biii), calculate the Holding Period Yield for (3 marks) [Hint: In computing the 1-year HPY for the bond investment, you figured that the correct answer could not be found by simply adding up the current yield and the 1year capital gains yield because the current yield, by definition, would fail to consider the reinvestment of the semi-annual coupons received during the year.] (a) City Pacific Airlines has just paid a dividend of $2.50 per share. The company is expected to increase its dividend by 8% next year before starting to reduce the growth rate by 2 percentage points every year (i.e., from 8% to 6% to 4% in each subsequent year) until it reaches the airline industry average of 2%, at which the growth rate will stay forever. What is the price of the stock today given the (yearly) required rate of return is 12% ? (5 marks) (b) Wonderland Inc. has just paid a dividend of $2.75 per share. The company has been following a highly stable dividend growth policy (practically at a constant rate) for many years and is expected to do so in the foreseeable future. What will be the price of Wonderland's stock five years from now if the market expects the company to pay a $2.86 dividend for next year and its equity cost of capital to be 11.7% ? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts