Question: step-by-step A B C and D 1) Reconsider the Special Products Company problem presented in Section 1.2. Although the company is well qualified to do

step-by-step

A

B

C

and D

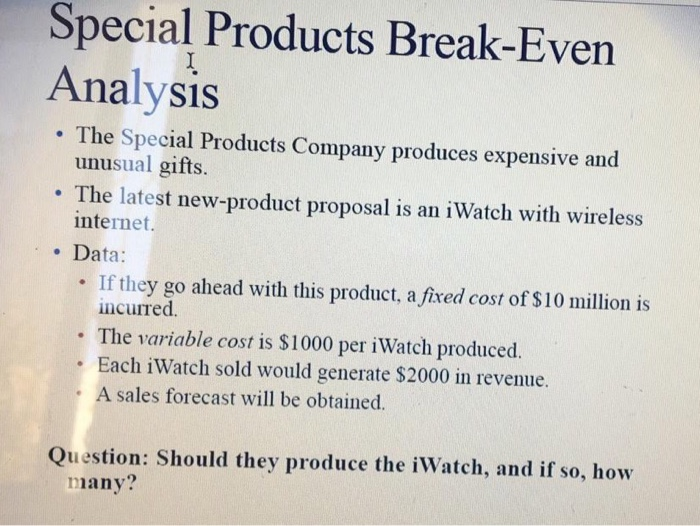

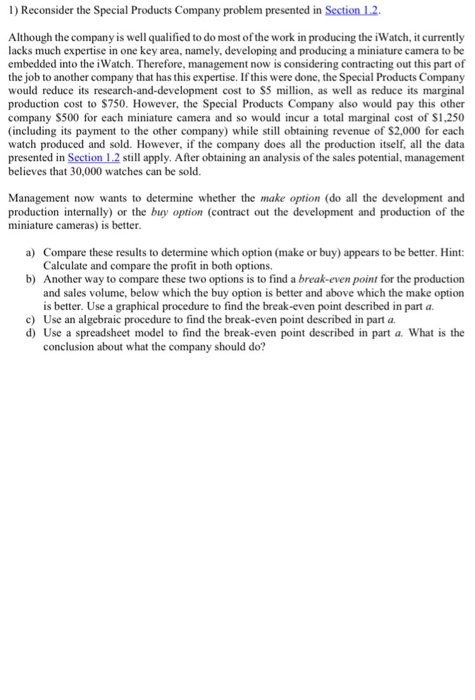

1) Reconsider the Special Products Company problem presented in Section 1.2. Although the company is well qualified to do most of the work in producing the iWatch, it currently lacks much expertise in one key area, namely, developing and producing a miniature camera to be embedded into the iWatch. Therefore, management now is considering contracting out this part of the job to another company that has this expertise. If this were done, the Special Products Company would reduce its research-and-development cost to $5 million, as well as reduce its marginal production cost to $750. However, the Special Products Company also would pay this other company $500 for each miniature camera and so would incur a total marginal cost of $1,250 (including its payment to the other company) while still obtaining revenue of $2,000 for each watch produced and sold. However, if the company does all the production itself , all the data presented in Section 1.2 still apply. After obtaining an analysis of the sales potential, management believes that 30,000 watches can be sold. Management now wants to determine whether the make option (do all the development and production internally) or the buy option (contract out the development and production of the miniature cameras) is better. a) Compare these results to determine which option (make or buy) appears to be better. Hint: Calculate and compare the profit in both options. b) Another way to compare these two options is to find a break-even point for the production and sales volume, below which the buy option is better and above which the make option is better. Use a graphical procedure to find the break-even point described in part a. c) Use an algebraic procedure to find the break-even point described in part a. d) Use a spreadsheet model to find the break-even point described in part a. What is the conclusion about what the company should do? Special Products Break-Even Analysis I . . The Special Products Company produces expensive and unusual gifts. The latest new-product proposal is an iWatch with wireless internet. Data: If they go ahead with this product, a fixed cost of $10 million is incurred. The variable cost is $1000 per iWatch produced. Each iWatch sold would generate $2000 in revenue. A sales forecast will be obtained. Question: Should they produce the iWatch, and if so, how many? FixedCo 1 Spe cost , a production cost of 10 would be incurred for each unit of the product produced. Each unit sold would generate $20 in revenue. Develop a mathematical expression for the monthly profit that would be generated by this produc in terms of the number of units produced and sold per month. Then determine how large this number needs to be each month to make it profitable to produce the product 2.Management of the Toys R4U Company needs to decide whether to introduce a certain new novelty toy for the upcoming Christmas season, after which it would be discontinued. The total cost required to produce and market this toy would be $500,000 plus S15 per toy produced. The company would receive revenue of $35 for each toy sold. a) Assuming that every unit of this toy that is produced is sold, write an expression for the profit in terms of the number produced and sold. Then find the break-even point that this number must exceed to make it worthwhile to introduce this toy. b) Now assume that the number that can be sold might be less than the number produced. Write an expression for the profit in terms of these two numbers. 2 3 4 5 6 7 8 9 10 11 12 13