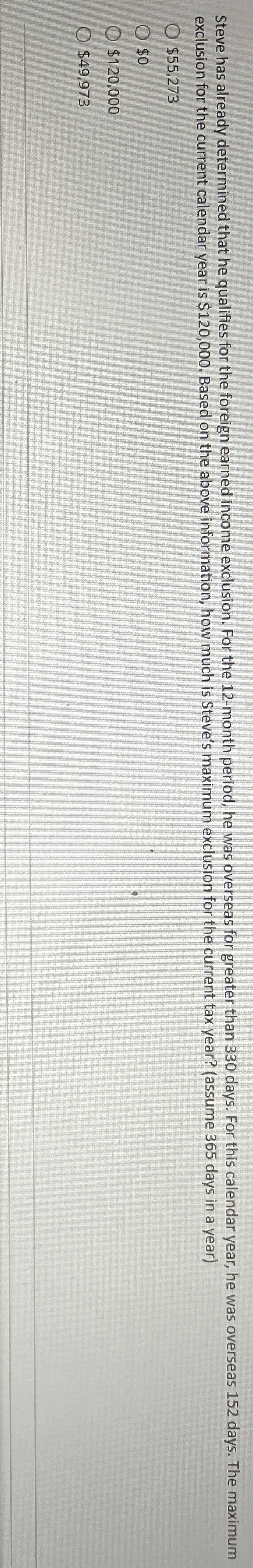

Question: Steve has already determined that he qualifies for the foreign earned income exclusion. For the 1 2 - month period, he was overseas for greater

Steve has already determined that he qualifies for the foreign earned income exclusion. For the month period, he was overseas for greater than days. For this calendar year, he was overseas days. The maximum

exclusion for the current calendar year is $ Based on the above information, how much is Steve's maximum exclusion for the current tax year? assume days in a year

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock