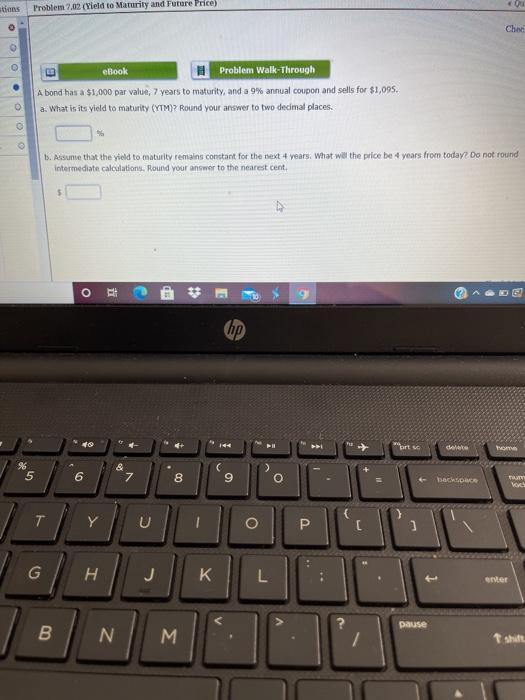

Question: stions Problem 7.02 (Yield to Maturity and Future Price) 0 Chec ebook Problem Walk-Through A bond has a $1,000 par value, 7 years to maturity,

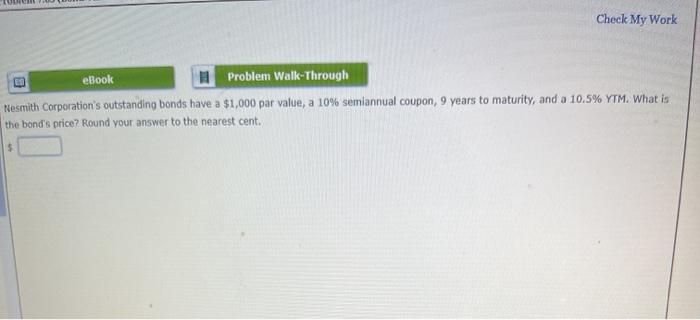

stions Problem 7.02 (Yield to Maturity and Future Price) 0 Chec ebook Problem Walk-Through A bond has a $1,000 par value, 7 years to maturity, and a 9% annual coupon and sells for $1,095. a. What is its yield to maturity (YTM)? Round your answer to two decimal places. 1. Assume that the yield to maturity remains constant for the next 4 years. What will the price be 4 years from today? Do not found intermediate calculations. Round your answer to the nearest cent, $ 4 a O hop bits delet ho %% 5 6 & 7 8 9 o back Y C O P [ H J K L enter Dause B N M / t shit Check My Work eBook Problem Walk-Through Nesmith Corporation's outstanding bonds have a $1,000 par value, a 10% semiannual coupon, 9 years to maturity, and a 10.5% YTM. What is the bond's price? Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts