Question: Stochastic methods in applied finance question: Alex is looking to price a 6 month European put option with a strike price of $29 on a

Stochastic methods in applied finance question:

Alex is looking to price a 6 month European put option with a strike price of $29 on a share in Omni Consumer Products (OCP). The current price for an OCP share is $20. Alex has used past data and his own judgement to estimate the volatility of these shares to be 15% per annum. The risk free continuously compounding interest rate is 5% per year.

(a) Construct a 3-step binomial tree showing the possible share prices over the next 6 months. Also, clearly show the corresponding probabilities for an upward and a downward movement in the share price.

As a check, the numbers 26.5419 and 31.8945 should appear in your tree.

(b) Using the binomial tree in part (a) and the information given above, calculate the corresponding 3 step tree containing the corresponding option values, and clearly state the fair price of the option according to the given information.

As a check, the numbers 0.157 and 0.7820 should appear in your tree.

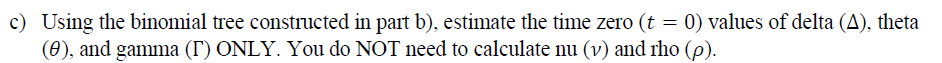

c) Using the binomial tree constructed in pait b), estimate the time zero (t = 0) values of delta (A), theta (2), and gamma (T) ONLY. You do NOT need to calculate nu (v) and rho (p). c) Using the binomial tree constructed in pait b), estimate the time zero (t = 0) values of delta (A), theta (2), and gamma (T) ONLY. You do NOT need to calculate nu (v) and rho (p)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts