Question: STOCK A AND C IS IN THE ACTIVE PORTFOLIO e). What is the alpha and beta of the Active Portfolio? g). What is the reward

STOCK A AND C IS IN THE ACTIVE PORTFOLIO

STOCK A AND C IS IN THE ACTIVE PORTFOLIO

e). What is the alpha and beta of the Active Portfolio?

g). What is the reward to risk ratio of the Active Portfolio? (2 marks)

h). Derive the information ratio for the Active Portfolio and provide a description of what the information ratio means. (1.5 marks)

i). The optimal weighting in the Active Portfolio w*A is ____________ and the optimal weighting in the Market Portfolio is ___________?

j). What is the Sharpe Ratio of your resulting Optimal Risky Portfolio P* comprising the combination of your Active Portfolio with the Market Portfolio? (2 marks)

Enter your answer to 4 decimal places eg if your answer is 6.54% enter as 0.0654.

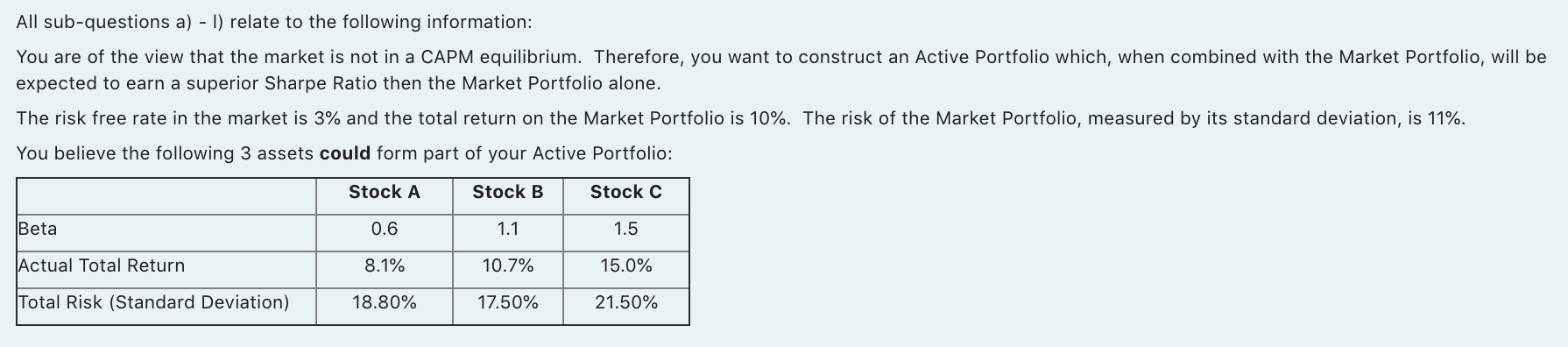

All sub-questions a) - 1) relate to the following information: You are of the view that the market is not in a CAPM equilibrium. Therefore, you want to construct an Active Portfolio which, when combined with the Market Portfolio, will be expected to earn a superior Sharpe Ratio then the Market Portfolio alone. The risk free rate in the market is 3% and the total return on the Market Portfolio is 10%. The risk of the Market Portfolio, measured by its standard deviation, is 11%. You believe the following 3 assets could form part of your Active Portfolio: Stock A Stock B Stock C Beta 0.6 1.1 1.5 Actual Total Return 8.1% 10.7% 15.0% Total Risk (Standard Deviation) 18.80% 17.50% 21.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts