Question: i) A portfolio manager summarises the input from forecasts in the following table: Financial Asset Average return Beta (B2 Residual standard deviation (8) Stock A

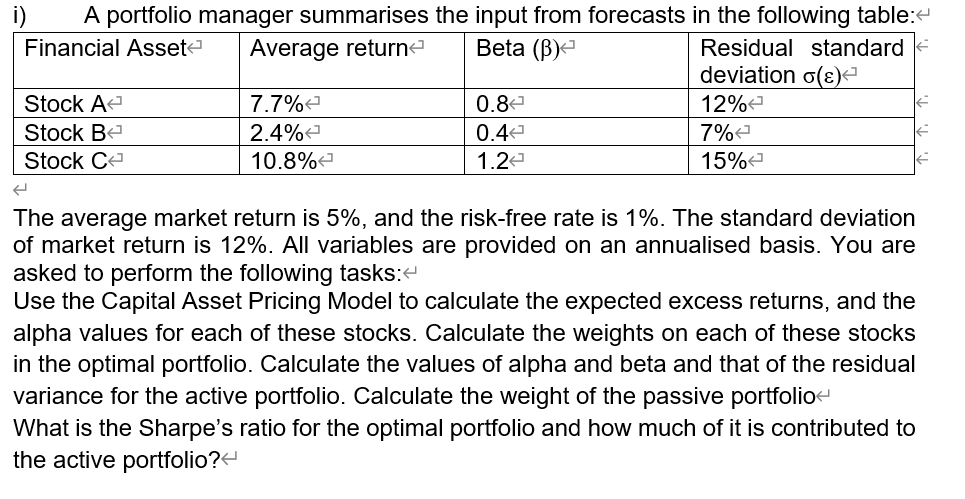

i) A portfolio manager summarises the input from forecasts in the following table: Financial Asset Average return Beta (B2 Residual standard deviation (8) Stock A 7.7% 0.82 12% Stock Be 2.4% 0.42 7% Stock Ce 10.8% 1.22 15% %7 The average market return is 5%, and the risk-free rate is 1%. The standard deviation of market return is 12%. All variables are provided on an annualised basis. You are asked to perform the following tasks:- Use the Capital Asset Pricing Model to calculate the expected excess returns, and the alpha values for each of these stocks. Calculate the weights on each of these stocks in the optimal portfolio. Calculate the values of alpha and beta and that of the residual variance for the active portfolio. Calculate the weight of the passive portfolio What is the Sharpe's ratio for the optimal portfolio and how much of it is contributed to the active portfolio? i) A portfolio manager summarises the input from forecasts in the following table: Financial Asset Average return Beta (B2 Residual standard deviation (8) Stock A 7.7% 0.82 12% Stock Be 2.4% 0.42 7% Stock Ce 10.8% 1.22 15% %7 The average market return is 5%, and the risk-free rate is 1%. The standard deviation of market return is 12%. All variables are provided on an annualised basis. You are asked to perform the following tasks:- Use the Capital Asset Pricing Model to calculate the expected excess returns, and the alpha values for each of these stocks. Calculate the weights on each of these stocks in the optimal portfolio. Calculate the values of alpha and beta and that of the residual variance for the active portfolio. Calculate the weight of the passive portfolio What is the Sharpe's ratio for the optimal portfolio and how much of it is contributed to the active portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts