Question: Stock A is currently trading @ 5500. A Long Strangle can be created by buying 50 Put strike 5400 @premium of 40 each and

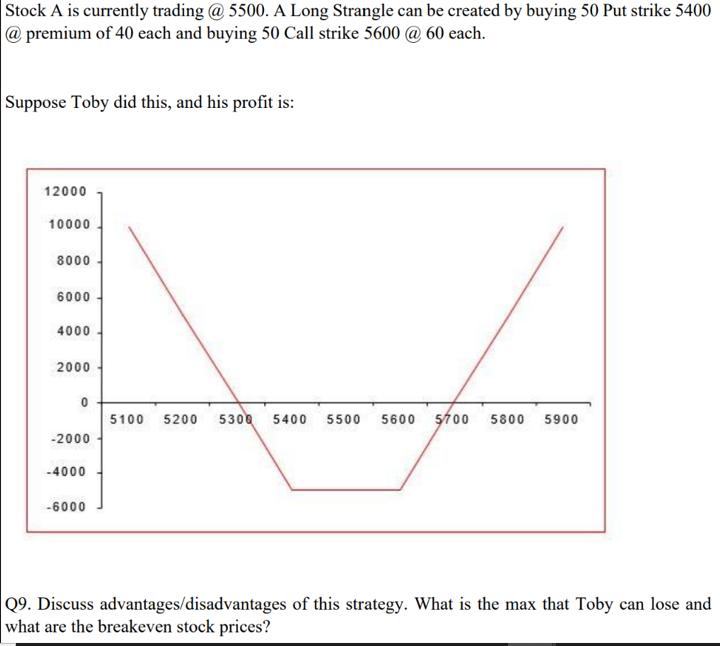

Stock A is currently trading @ 5500. A Long Strangle can be created by buying 50 Put strike 5400 @premium of 40 each and buying 50 Call strike 5600 @ 60 each. Suppose Toby did this, and his profit is: 12000 10000 8000 6000 4000 2000 0 -2000 -4000 -6000 5100 5200 5300 J 5400 5500 5600 5700 5800 5900 Q9. Discuss advantages/disadvantages of this strategy. What is the max that Toby can lose and what are the breakeven stock prices?

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Lets start by defining a long strangle options strategy A long strangle strategy involves purchasing a put option and a call option with the same expi... View full answer

Get step-by-step solutions from verified subject matter experts