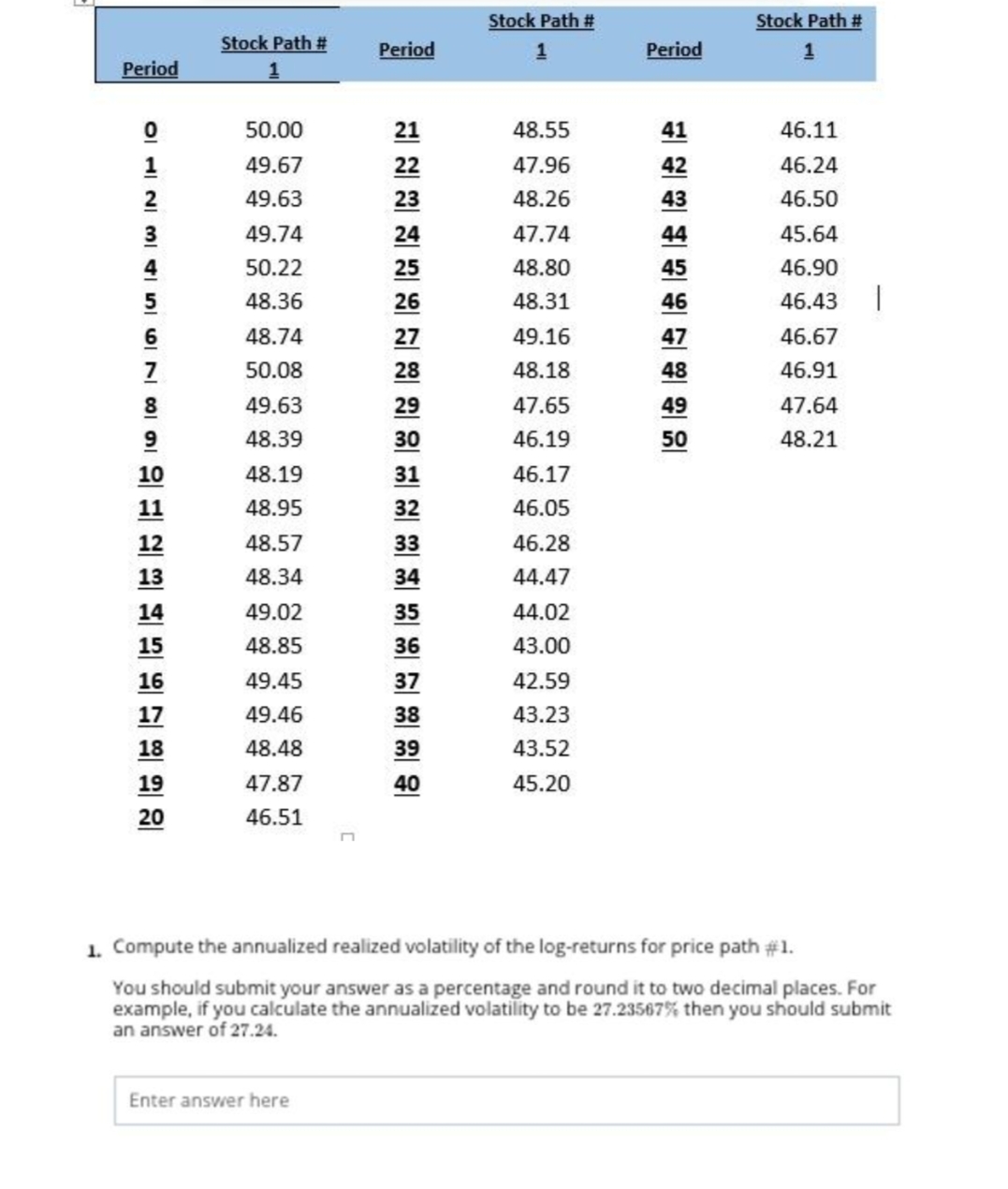

Question: Stock Path # Stock Path # Stock Path # Period 1 Period 1 Period 1 50.00 21 48.55 41 46.11 49.67 47.96 #2 46.24 49.63

Stock Path # Stock Path # Stock Path # Period 1 Period 1 Period 1 50.00 21 48.55 41 46.11 49.67 47.96 #2 46.24 49.63 23 48.26 46.50 49.74 24 47.74 44 45.64 50.22 48.80 45 46.90 48.36 48.31 46 46.43 48.74 49.16 47 46.67 50.08 48.18 48 46.91 GETRE 5 10. IV In INT IA IW IN IN 10 49.63 47.65 49 47.64 48.39 30 46.19 50 48.21 48.19 31 46.17 48.95 46.05 48.57 33 46.28 48.34 34 44.47 49.02 35 44.02 48.85 36 43.00 16 49.45 37 42.59 17 49.46 38 43.23 18 48.48 39 43.52 19 47.87 40 45.20 20 46.51 n 1. Compute the annualized realized volatility of the log-returns for price path #1. You should submit your answer as a percentage and round it to two decimal places. For example, if you calculate the annualized volatility to be 27.23567% then you should submit an answer of 27.24. Enter answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts