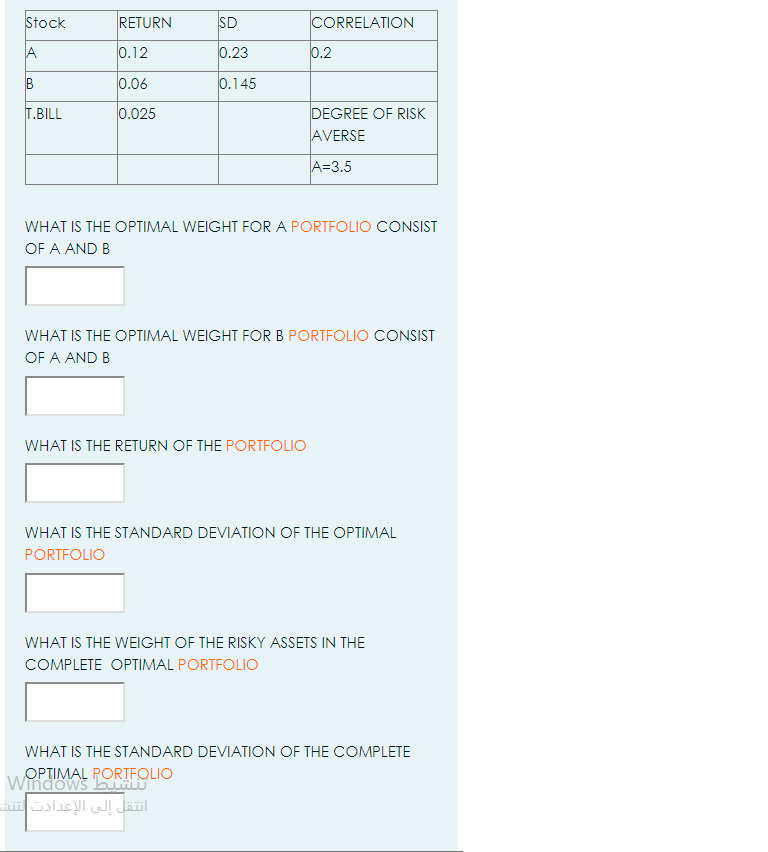

Question: Stock RETURN SD CORRELATION A 0.12 0.23 0.2 B B 0.06 0.145 T.BILL 0.025 DEGREE OF RISK AVERSE A=3.5 WHAT IS THE OPTIMAL WEIGHT FOR

Stock RETURN SD CORRELATION A 0.12 0.23 0.2 B B 0.06 0.145 T.BILL 0.025 DEGREE OF RISK AVERSE A=3.5 WHAT IS THE OPTIMAL WEIGHT FOR A PORTFOLIO CONSIST OF A AND B WHAT IS THE OPTIMAL WEIGHT FOR B PORTFOLIO CONSIST OF A AND B WHAT IS THE RETURN OF THE PORTFOLIO WHAT IS THE STANDARD DEVIATION OF THE OPTIMAL PORTFOLIO WHAT IS THE WEIGHT OF THE RISKY ASSETS IN THE COMPLETE OPTIMAL PORTFOLIO WHAT IS THE STANDARD DEVIATION OF THE COMPLETE Windows but OPTIMAL PORTFOLIO w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts