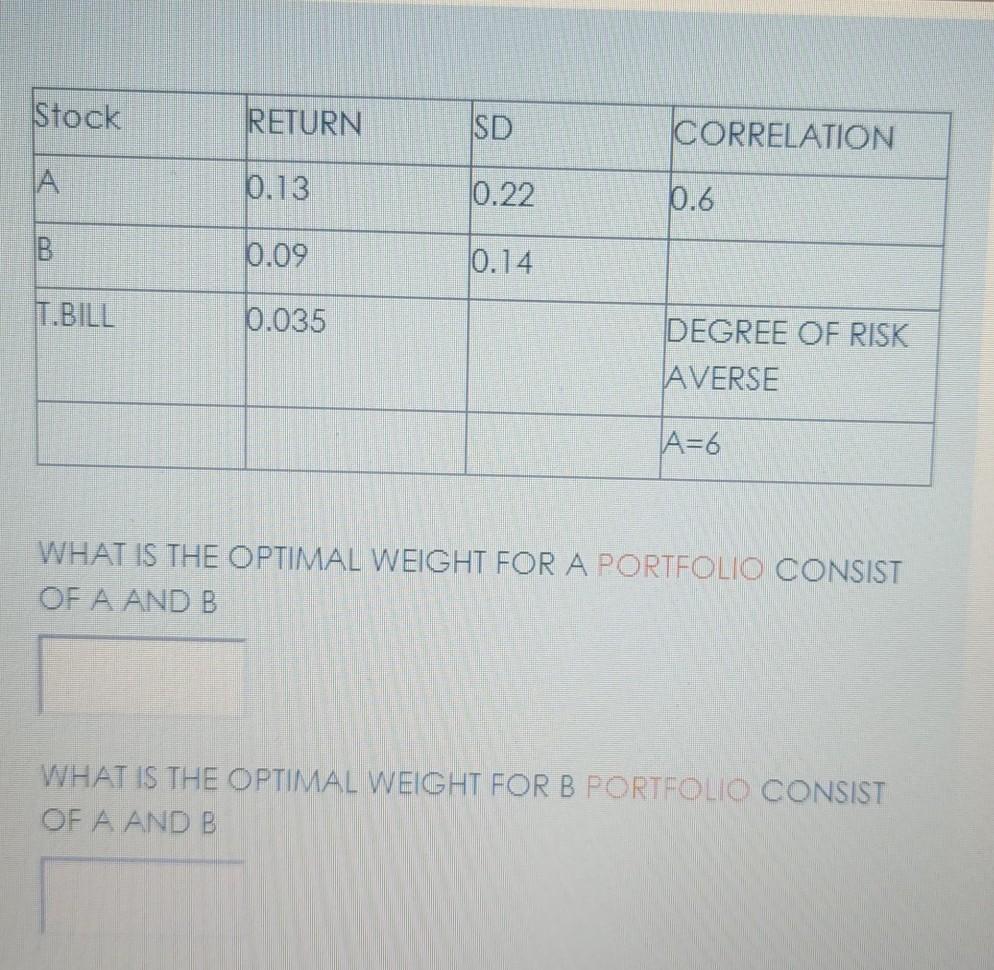

Question: Stock RETURN SD CORRELATION A 0.13 0.22 0.6 B 0.09 0.14 T.BILL 0.035 DEGREE OF RISK AVERSE A=6 WHAT IS THE OPTIMAL WEIGHT FOR A

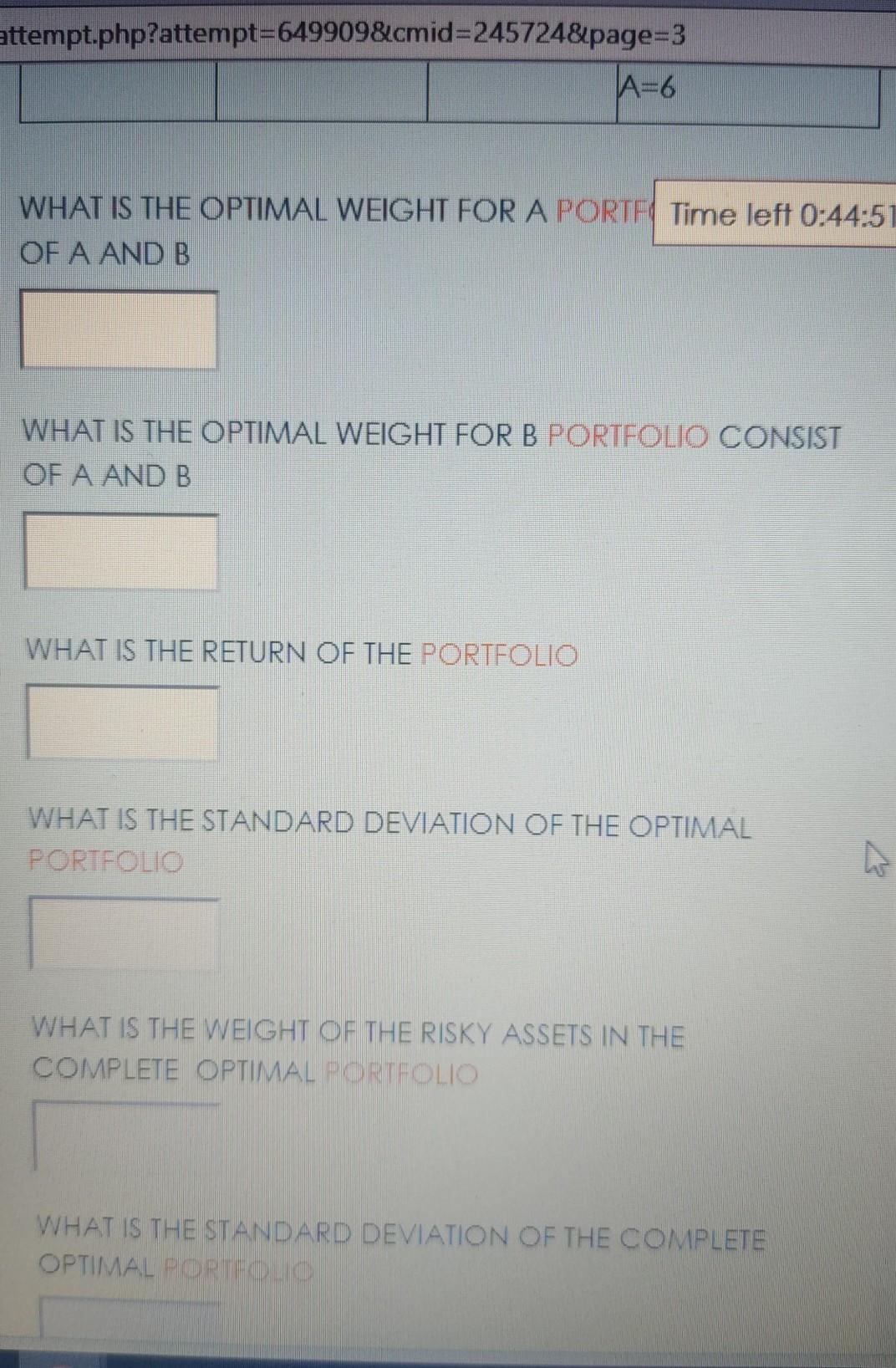

Stock RETURN SD CORRELATION A 0.13 0.22 0.6 B 0.09 0.14 T.BILL 0.035 DEGREE OF RISK AVERSE A=6 WHAT IS THE OPTIMAL WEIGHT FOR A PORTFOLIO CONSIST OF A AND B WHAT IS THE OPTIMAL WEIGHT FOR B PORTFOLIO CONSISTI OF A AND B attempt.php?attempt=6499098cmid=245724&page=3 A=6 WHAT IS THE OPTIMAL WEIGHT FOR A PORTF Time left 0:44:51 OF A AND B WHAT IS THE OPTIMAL WEIGHT FOR B PORTFOLIO CONSIST OF A AND B WHAT IS THE RETURN OF THE PORTFOLIO WHAT IS THE STANDARD DEVIATION OF THE OPTIMAL PORTFOLIO W WHAT IS THE WEIGHT OF THE RISKY ASSETS IN THE COMPLETE OPTIMAL PORTFOLIO WHAT IS THE STANDARD DEVIATION OF THE COMPLETE OPTIMAL POR HOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts