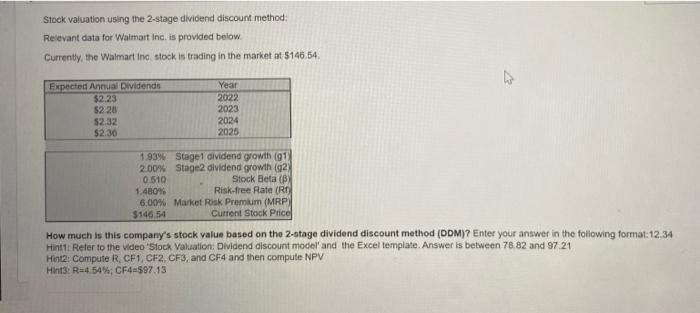

Question: Stock valuation using the 2-stage dividend discount method: Relevant data for Walmart Inc. is provided below Currently, the Walmart in stock is trading in the

Stock valuation using the 2-stage dividend discount method: Relevant data for Walmart Inc. is provided below Currently, the Walmart in stock is trading in the market at $146.54 4 Expected Annual Dividends $2.23 $220 $2.32 $2.30 Year 2022 2023 2024 2025 1.93% Stage 1 dividend growth (91 2.00% Stage2 dividend growth (2) 0.510 Stock Beta (BX 1.430% Risk-free Rate (RO) 6,00% Market Rosk Premium (MRP $146.54 Current Stock Price How much is this company's stock value based on the 2-stage dividend discount method (ODM)? Enter your answer in the following format:12.34 Hint: Refer to the video Stock Valuation Dividend discount model and the Excel template. Answer is between 78.82 and 97 21 Hint2: Compute R. CF1, CF2, CF3, and CF4 and then compute NPV Hint: R=4 54%, CF4-597.13

Step by Step Solution

There are 3 Steps involved in it

To calculate the stock value using the 2stage Dividend Discount Model DDM follow these steps Step 1 ... View full answer

Get step-by-step solutions from verified subject matter experts