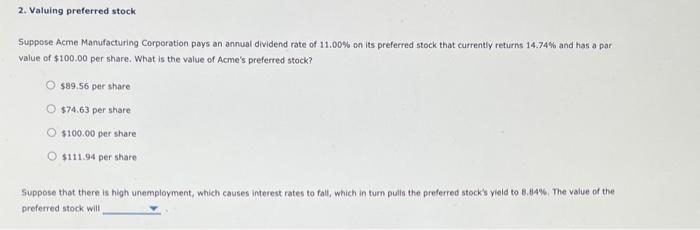

Question: Stock will Increase of Decrease? Suppose Acme Manufacturing Corporation pays an annual dividend rate of 11.00% on its preferred stock that currently returns 14.74% and

Suppose Acme Manufacturing Corporation pays an annual dividend rate of 11.00% on its preferred stock that currently returns 14.74% and has a par value of $100.00 per share. What is the value of Acme's preferred stock? 589,56 per share $74.63 per share $100.00 per share $111.94 per share Suppose that there is high unemployment, which causes interest rates to foll, which in turn pulls the preferred stock's yield to B.8A\%. The value of the prefetred stock will

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts