Question: Stock X has a 10.0% expected return, a beta coefficient of 0.9, and a 30% standard deviation of expected returns. Stock Y has a 12.0%

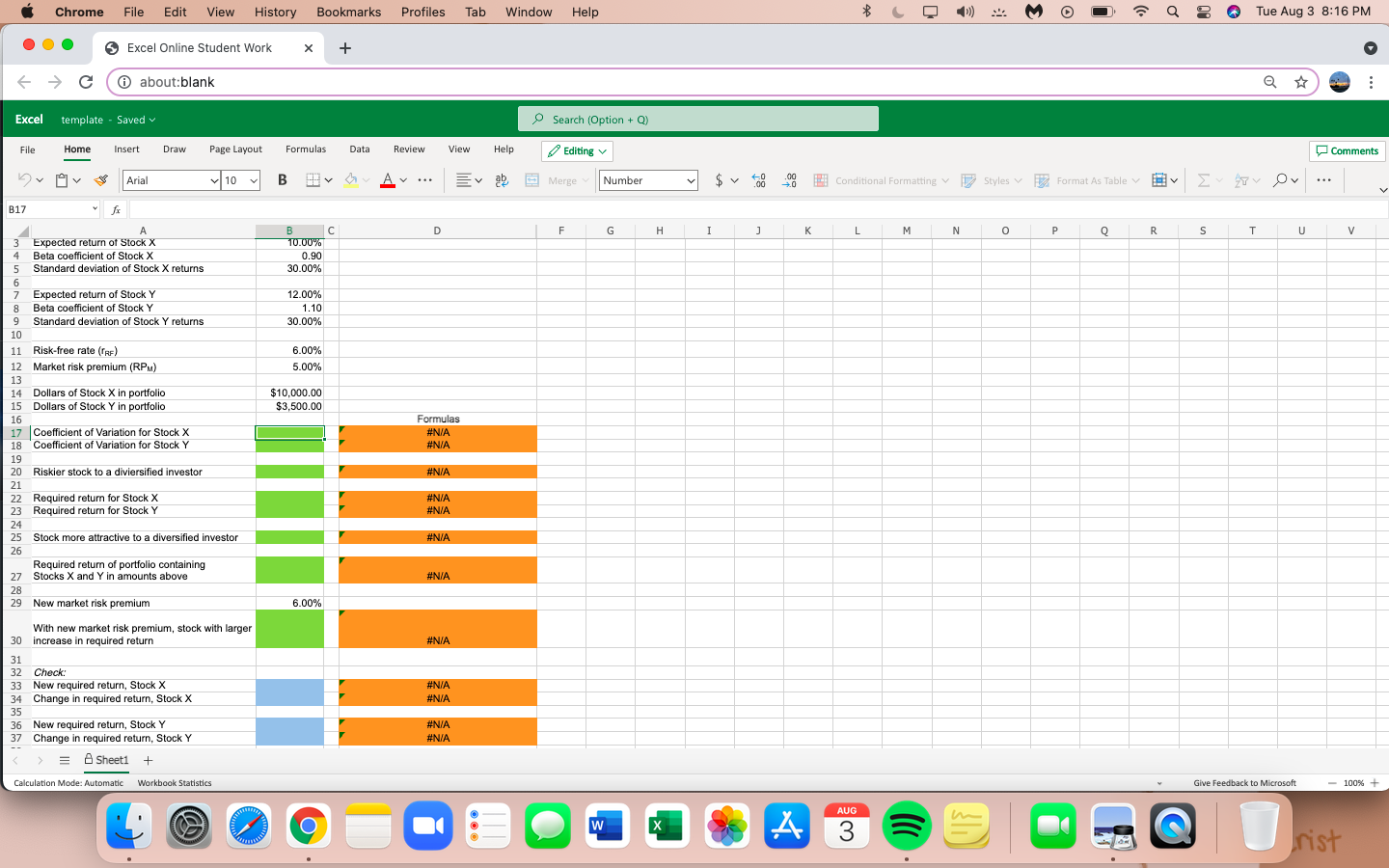

Stock X has a 10.0% expected return, a beta coefficient of 0.9, and a 30% standard deviation of expected returns. Stock Y has a 12.0% expected return, a beta coefficient of 1.1, and a 30.0% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below.

-

Calculate each stock's coefficient of variation. Round your answers to two decimal places. Do not round intermediate calculations.

CVx = ______

CVy = ______

-

Which stock is riskier for a diversified investor?

- For diversified investors the relevant risk is measured by standard deviation of expected returns. Therefore, the stock with the higher standard deviation of expected returns is more risky. Stock X has the higher standard deviation so it is more risky than Stock Y.

- For diversified investors the relevant risk is measured by beta. Therefore, the stock with the lower beta is more risky. Stock X has the lower beta so it is more risky than Stock Y.

- For diversified investors the relevant risk is measured by standard deviation of expected returns. Therefore, the stock with the lower standard deviation of expected returns is more risky. Stock Y has the lower standard deviation so it is more risky than Stock X.

- For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher beta is less risky. Stock Y has the higher beta so it is less risky than Stock X.

- For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher beta is more risky. Stock Y has the higher beta so it is more risky than Stock X.

-

Calculate each stock's required rate of return. Round your answers to two decimal places.

rx = _____%

ry = ______%

-

On the basis of the two stocks' expected and required returns, which stock would be more attractive to a diversified investor?

_________Stock X or Stock Y?

-

Calculate the required return of a portfolio that has $10,000 invested in Stock X and $3,500 invested in Stock Y. Do not round intermediate calculations. Round your answer to two decimal places.

rp = ________%

-

If the market risk premium increased to 6%, which of the two stocks would have the larger increase in its required return?

_________Stock X or Stock Y?

Chrome File Edit View History Bookmarks Profiles Tab Window Help * CQ Q Tue Aug 3 8:16 PM Excel Online Student Work x + E C about:blank Q Excel template - Saved O Search (Option +Q) ( File Home Insert Draw Page Layout Formulas Data Review View Help Editing Comments Arial 10 B v ab Merge Number $ 8.9 Conditional Formatting v Styles Format As Table ! vl I 28 Ov V B17 fr D F G H I J K L M N o P Q R S T U V B 10.00% 0.90 30.00% 12.00% 1.10 30.00% 6.00% 5.00% $10,000.00 $3,500.00 3 Expected return of Stock X 4 Beta coefficient of Stock X 5 Standard deviation of Stock X returns 6 7 Expected return of Stock Y 8 Beta coefficient of Stock Y 9 Standard deviation of Stock Y returns 10 11 Risk-free rate (RF) 12 Market risk premium (RPM) 13 14 Dollars of Stock X in portfolio 15 Dollars of Stock Y in portfolio 16 17 Coefficient of Variation for Stock X 18 Coefficient of Variation for Stock Y 19 20 Riskler stock to a diviersified investor 21 22 Required return for Stock X 23 Required return for Stock Y 24 25 Stock more attractive to a diversified investor 26 Required return of portfolio containing 27 Stocks X and Y in amounts above 28 29 New market risk premium Formulas #N/A #N/A #N/A #N/A #N/A #N/A #N/A 6.00% #N/A #N/A #N/A With new market risk premium, stock with larger 30 increase in required return 31 32 Check: 33 New required return, Stock X 34 Change in required return, Stock X 35 36 New required return, Stock Y 37 Change in required return, Stock Y = Sheet1 + Calculation Mode: Automatic #N/A #N/A Workbook Statistics Give Feedback to Microsoft 100% + AUG W 3 all o Crist

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts