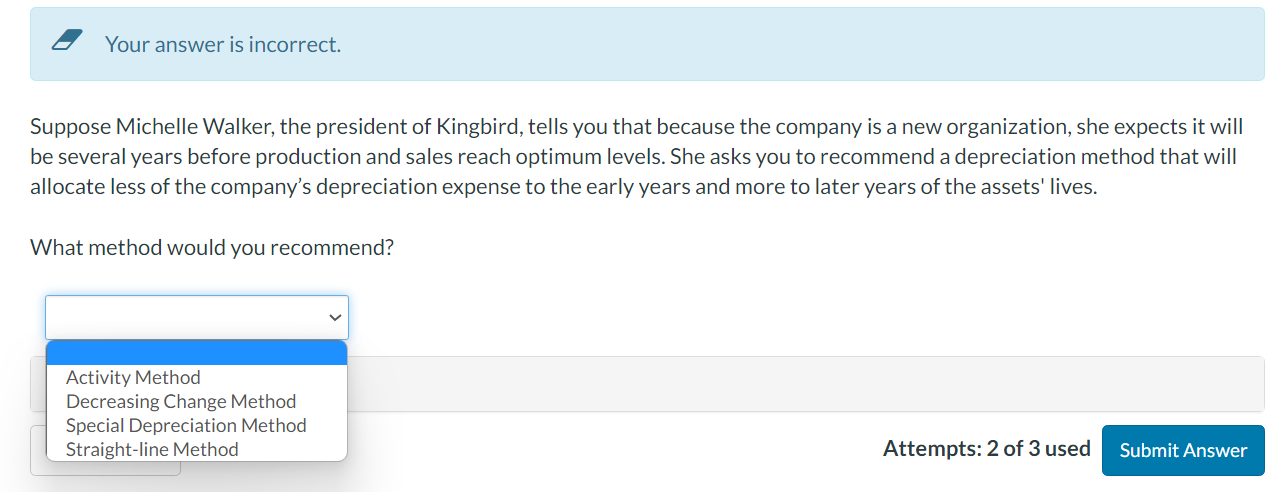

Question: Straight-line Method and Special Depreciation Method are both incorrect, so the choices are between Activity Method and Decreasing Change Method. Your answer is incorrect. Suppose

Straight-line Method and Special Depreciation Method are both incorrect, so the choices are between Activity Method and Decreasing Change Method.

Your answer is incorrect. Suppose Michelle Walker, the president of Kingbird, tells you that because the company is a new organization, she expects it will be several years before production and sales reach optimum levels. She asks you to recommend a depreciation method that will allocate less of the company's depreciation expense to the early years and more to later years of the assets' lives. What method would you recommend? Attempts: 2 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts