Question: STRATEGY CAPSULE 2.2 Diagnosing Performance: UPS vs. FedEx Between 2010 and 2014, United Parcel Service (UPS) has earned more than double the return on assets

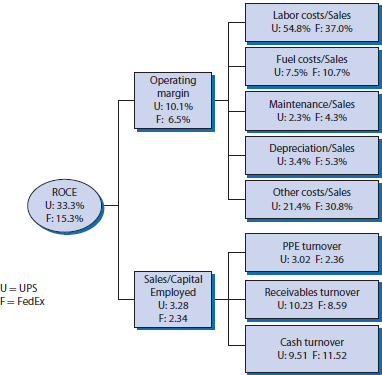

STRATEGY CAPSULE 2.2 Diagnosing Performance: UPS vs. FedEx Between 2010 and 2014, United Parcel Service (UPS) has earned more than double the return on assets as its closest rival, FedEx Corporation. What insights can financial analysis offer into the sources of this performance differential? Disaggregating the companies' return on capital employed into operating margin and capital turnover shows that differences in ROCE are due to UPS's superior operating margin and higher capital turnover. See Figure 2.2. FIGURE 2.2 Analyzing why UPS earns a higher return on capital employed (ROCE) than FedEx (F) Image Probing UPS's higher operating margin highlights major differences in the cost structure of the two companies: UPS is more labor intensive with a much higher ratio of employee costs to sales (however, UPS's average compensation per employee is much lower than FedEx's). FedEx has higher costs of fuel, maintenance, depreciation, and other. UPS's higher capital turnover is mainly due to its higher turnover of fixed assets (property, plant, and equipment). These differences reflect the different composition of the two companies' businesses. UPS is more heavily involved in ground transportation (UPS has 103,000 vehicles; FedEx has 55,000), which tends to be more labor intensive. FedEx is more oriented toward air transportation (UPS has 620 aircraft; FedEx has 650). Express delivery services tend to be less profitable than ground delivery. However, the differences in business mix do not appear to completely explain the wide discrepancy in fuel, maintenance, and other costs between FedEx and UPS. The likelihood is that UPS has superior operational efficiency.

- With regard to Strategy Capsule 2.2, what additional data would you seek and what additional analysis would you undertake to investigate further the reasons for UPS's superior profitability to FedEx?

Labor costs/Sales U: 54.8% F: 37.0% Fuel costs/Sales U:7.5% F: 10.7% Operating margin U: 10.1% F: 6.5% U: 2.3% F: 4.3% Depreciation/Sales U:3.496 F: 5.396 ROCE U: 33.3% F: 15.3% Other costs/Sales U: 21.4% F: 30.8% PPE turnover U: 3.02 F: 2.36 Sales/Capital Employed U: 3.28 F:2.34 U-UPS F FedEx Receivables turnover U: 10.23 F:8.59 Cash turnover U:9.51 F: 11.52 Labor costs/Sales U: 54.8% F: 37.0% Fuel costs/Sales U:7.5% F: 10.7% Operating margin U: 10.1% F: 6.5% U: 2.3% F: 4.3% Depreciation/Sales U:3.496 F: 5.396 ROCE U: 33.3% F: 15.3% Other costs/Sales U: 21.4% F: 30.8% PPE turnover U: 3.02 F: 2.36 Sales/Capital Employed U: 3.28 F:2.34 U-UPS F FedEx Receivables turnover U: 10.23 F:8.59 Cash turnover U:9.51 F: 11.52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts