Question: StreamX. Spotify is looking at another potential acquisition in the music field. The music service, StreamX, has projected sales of $125 million next year. Costs

StreamX. Spotify is looking at another potential acquisition in the music field. The music service, StreamX, has projected sales of $125 million next year. Costs (including depreciation) are expected to be 74 percent of sales and depreciation and net investment (PPE and working capital) are expected to be 3 percent and 5 percent of sales, respectively. Sales are expected to grow at 20 percent the following year, with the growth rate declining by 4 percentage points per year until the growth rate reaches 4 percent, where it is expected to then drop to 3 percent the next year and remain there indefinitely. StreamX has debt of $65 million outstanding . There are 1.5 million shares of stock outstanding and investors require a return of 12 percent on the company's stock. The corporate tax rate is 25 percent.

Create a new Excel worksheet tab with the name of the company at the top. Show all steps in your process to answer the following questions.

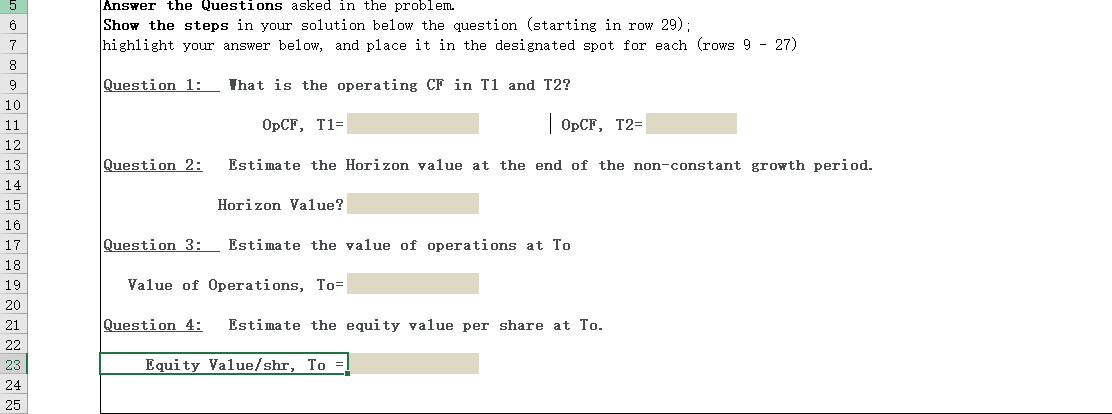

Start a new worksheet tab to answer this question. What is your estimate of the value of StreamX today? In answering, provide an explicit detailing of the following: The Operating Cash flow in T1 and T2. The Horizon value at the end of the non-constant growth period. Your estimate of the Value of Operations. Your estimate of the Equity value per share.

Use Excel to show work.

6 7 8 9 Answer the Questions asked in the problem Show the steps in your solution below the question (starting in row 29); highlight your answer below, and place it in the designated spot for each (rows 9 - 27) Question 1: _That is the operating CF in T1 and T2? OpCF, T1= OpCF, T2= Question 2: Estimate the Horizon value at the end of the non-constant growth period. Horizon Value? 10 11 12 13 14 15 16 17 18 19 20 21 22 Question 3: Estimate the value of operations at To Value of Operations, To= Question 4: Estimate the equity value per share at To. Equity Value/shr, To 23 24 25 6 7 8 9 Answer the Questions asked in the problem Show the steps in your solution below the question (starting in row 29); highlight your answer below, and place it in the designated spot for each (rows 9 - 27) Question 1: _That is the operating CF in T1 and T2? OpCF, T1= OpCF, T2= Question 2: Estimate the Horizon value at the end of the non-constant growth period. Horizon Value? 10 11 12 13 14 15 16 17 18 19 20 21 22 Question 3: Estimate the value of operations at To Value of Operations, To= Question 4: Estimate the equity value per share at To. Equity Value/shr, To 23 24 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts