Question: strictly dont use CHATGPT.Please type the answer with good explanation.Thank You PLEASE ANSWER THE TWO BLANK CELLS. THANK YOU 363 364 365 366 367 368

strictly dont use CHATGPT.Please type the answer with good explanation.Thank You

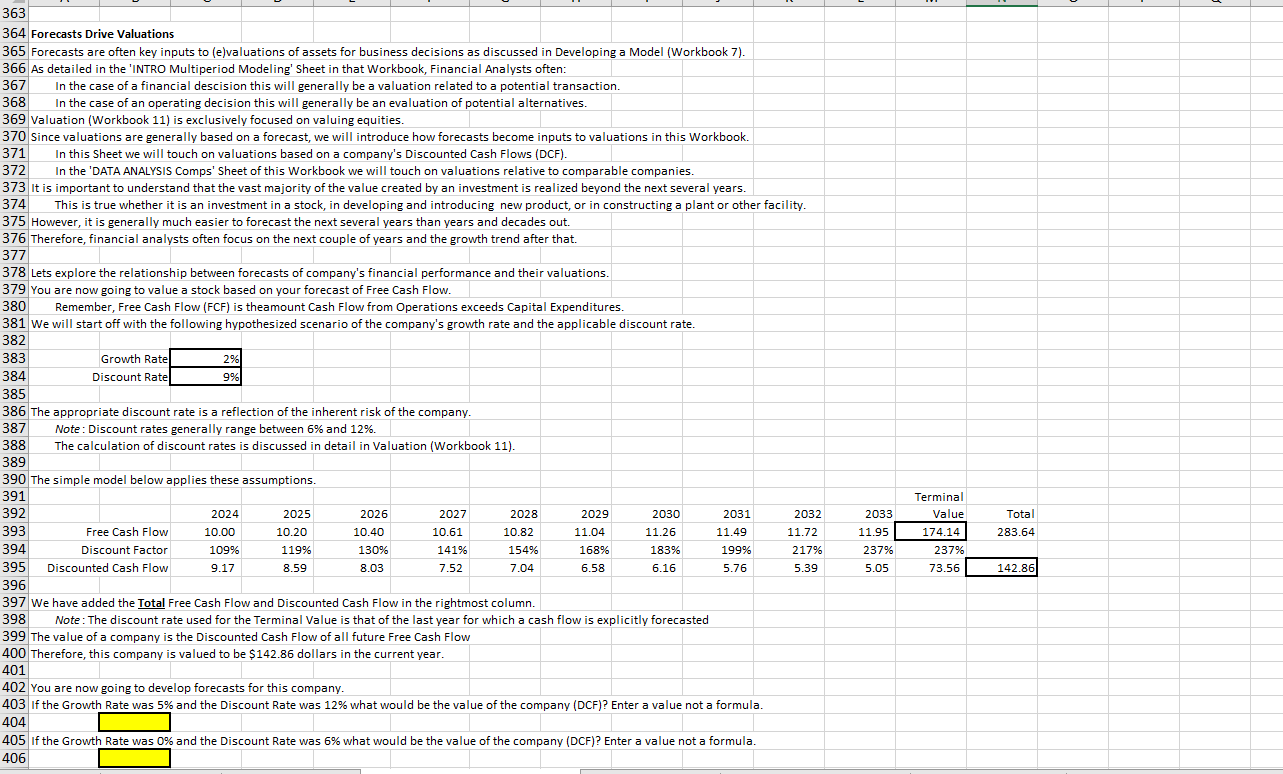

PLEASE ANSWER THE TWO BLANK CELLS. THANK YOU

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock