Question: Struggling to find Manager A's Allocation effect. Chapter 18 - HW MANAGER A MANAGER B BENCHMARK Weight Return 0.7 -5.0 % Weight Return Weight Return

Struggling to find Manager A's Allocation effect.

Struggling to find Manager A's Allocation effect.

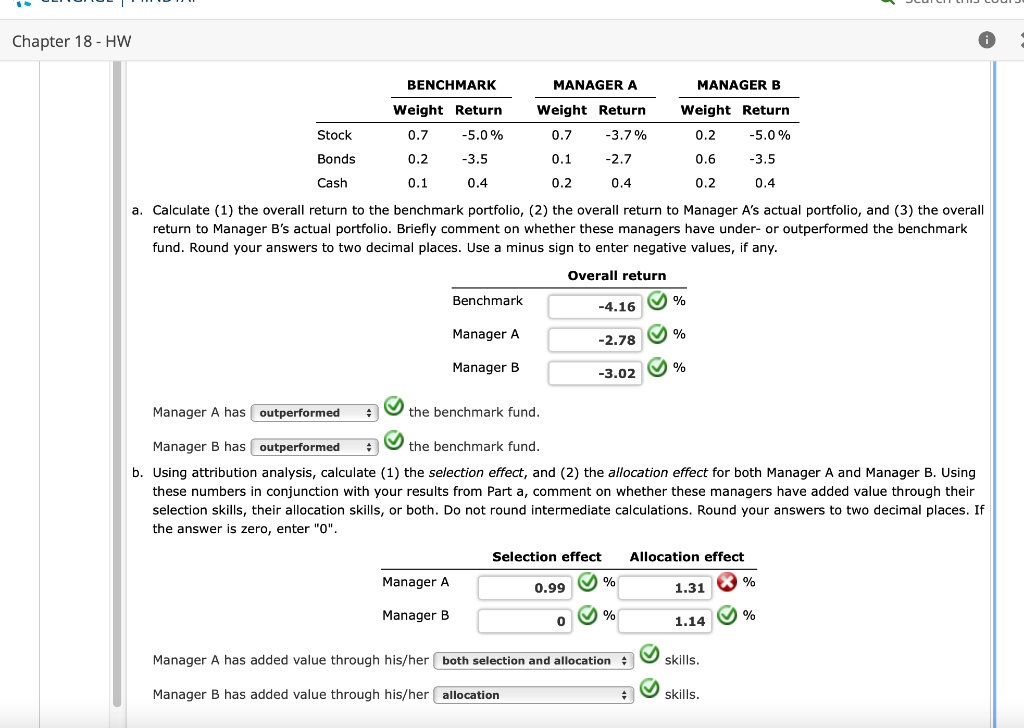

Chapter 18 - HW MANAGER A MANAGER B BENCHMARK Weight Return 0.7 -5.0 % Weight Return Weight Return Stock 0.7 -3.7% 0.2 -5.0% Bonds 0.2 0.1 -2.7 0.6 -3.5 -3.5 0.4 Cash 0.1 0.2 0.4 0.2 0.4 a. Calculate (1) the overall return to the benchmark portfolio, (2) the overall return to Manager A's actual portfolio, and (3) the overall return to Manager B's actual portfolio. Briefly comment on whether these managers have under- or outperformed the benchmark fund. Round your answers to two decimal places. Use a minus sign to enter negative values, if any. Overall return Benchmark -4.16 % Manager A % -2.78 Manager B % -3.02 Manager A has outperformed . the benchmark fund. Manager B has outperformed the benchmark fund. b. Using attribution analysis, calculate (1) the selection effect, and (2) the allocation effect for both Manager A and Manager B. Using these numbers in conjunction with your results from Part a, comment on whether these managers have added value through their selection skills, their allocation skills, or both. Do not round intermediate calculations. Round your answers to two decimal places. If the answer is zero, enter "0". Allocation effect Selection effect % Manager A % 0.99 1.31 Manager B 0 % 1.14 % Manager A has added value through his/her both selection and allocation : skills. Manager B has added value through his/her allocation skills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts